by Trust Counsel | Mar 18, 2021 | Articles, Celebrity Estates, Estate Planning, Family, Guardianship, Kids Protection Planning

Oprah’s bombshell interview with Prince Harry and Meghan Markle touched on themes that will sound familiar to any adult child estranged from their family: denied requests for compassion; being made the villain for not toeing the line; and, of course, the toxic...

by Trust Counsel | Feb 18, 2021 | Articles, Asset Protection, Celebrity Estates, Estate Planning, Family, Guardianship, Kids Protection Planning

Meghan Markle and Prince Harry announced their third pregnancy this past week; they are parents to nearly two-year-old Archie, and they lost a child to miscarriage this past summer. The famously private pair stepped down from official duties in the royal family...

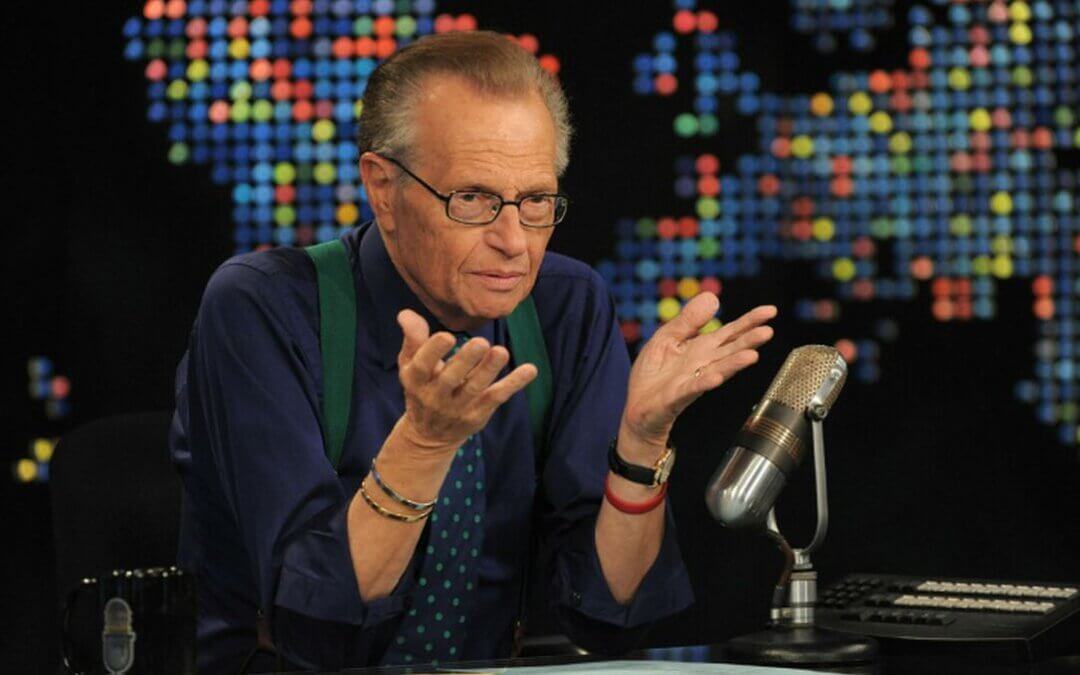

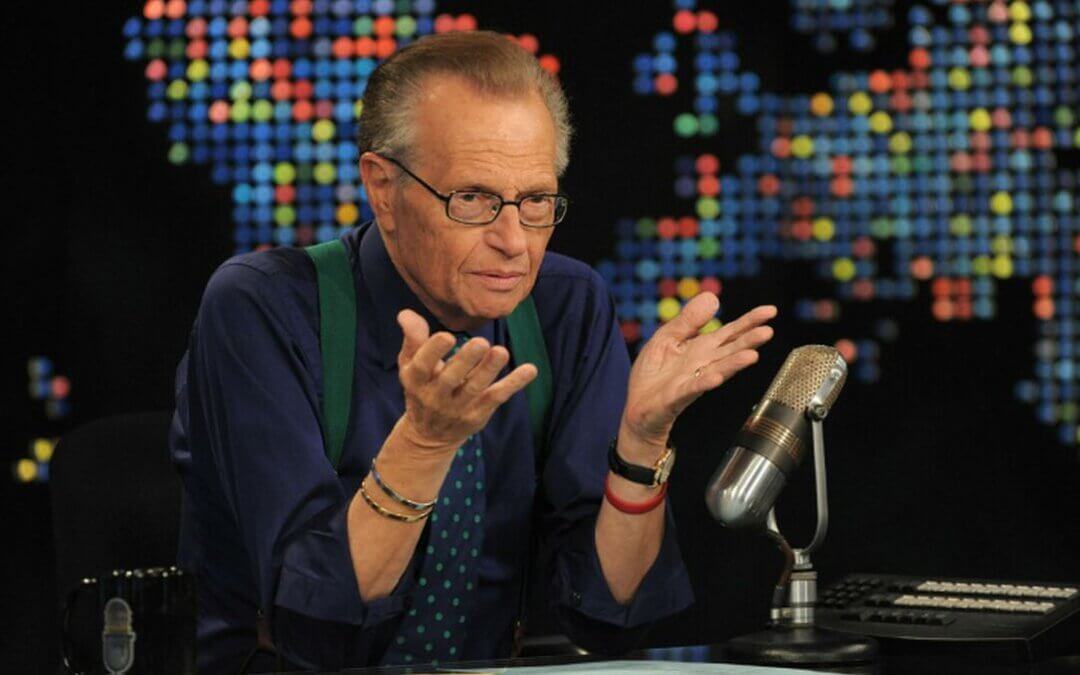

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...

by Trust Counsel | Feb 11, 2021 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Family, Financial, Guardianship, Health Care Directive, Income Tax, Inheritance

This week’s pandemic guilty-pleasure television takes a more serious look at the butt of our collective joke: Britney Spears, her 2007 breakdown, and the decade-plus control her father has exercised over her life and finances thanks to a conservatorship proceeding....

by Trust Counsel | Feb 5, 2021 | Articles, Asset Protection, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Inheritance, Intellectual Property, Kids Protection Planning, Liens/Debt, Trusts, Wills

Within the past year, a combination of new legislation and the recent change of leadership in the White House and Congress stands to dramatically increase the income taxes your loved ones will have to pay on inherited retirement accounts as well as increasing the...

by Trust Counsel | Jan 29, 2021 | Articles, Estate Planning, Family, Guardianship, Health Care Directive, Kids Protection Planning, Probate, Probate Litigation, Trusts, Vacation / Travel

Although you likely won’t need to have an entirely new estate plan prepared for you, upon relocating to another state, you should definitely have your existing plan reviewed by an estate planning lawyer who is familiar with your new home state’s laws. Each state has...