by Trust Counsel | Dec 19, 2022 | Articles, Estate Planning, Family, Incapacity, Intellectual Property, Trusts, Wills

If you have preferences about what happens to your digital footprint after your death, you need to take action. Otherwise, your online legacy will be determined for you—and not by you. If you have any online accounts, such as Gmail, Facebook, Instagram, LinkedIn,...

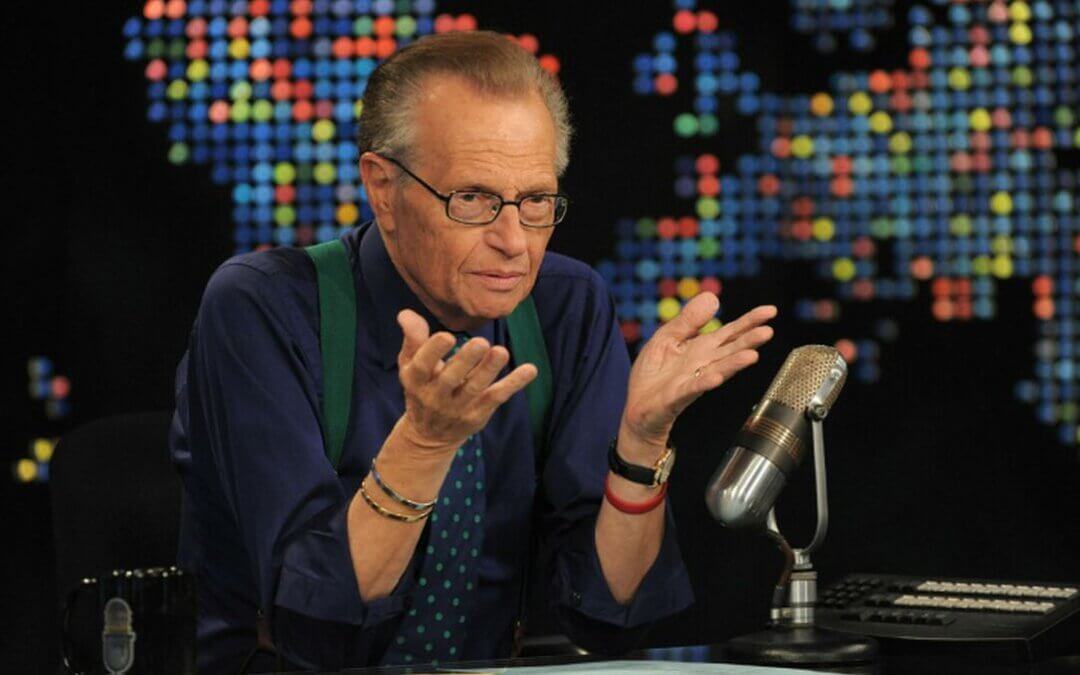

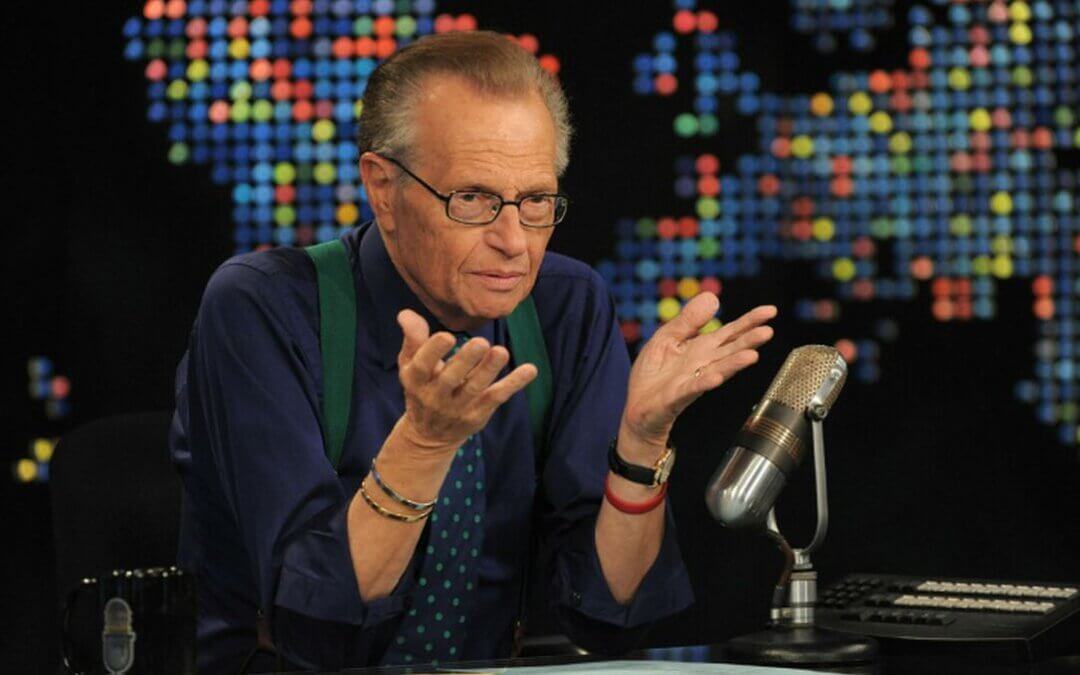

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...

by Trust Counsel | Feb 5, 2021 | Articles, Asset Protection, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Inheritance, Intellectual Property, Kids Protection Planning, Liens/Debt, Trusts, Wills

Within the past year, a combination of new legislation and the recent change of leadership in the White House and Congress stands to dramatically increase the income taxes your loved ones will have to pay on inherited retirement accounts as well as increasing the...

by Trust Counsel | Jan 29, 2021 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Estate Tax, Financial, Gift Tax, Health Care Directive, High Net Worth, Intellectual Property, Liens/Debt, Probate, Probate Litigation, Trusts, Wills

If you own a business, you almost certainly have intellectual property. However, because your intellectual property is intangible, it can be invisible to you and those who aren’t familiar with the nature of intellectual property and its value, so it often gets...

by Trust Counsel | Jan 21, 2021 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, High Net Worth, Income Tax, Inheritance, Intellectual Property, Probate, Probate Litigation, Real Property / Real Estate, Trusts, Wills

It’s hard to imagine that someone like Martin Luther King, Jr. would end up being the focus of almost endless court battles. After all, Dr. King was the unfaltering champion of peaceful resistance during his quest for full and equal civil rights for all Americans. He...

by Trust Counsel | Jan 15, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Kids Protection Planning

With people living longer than ever before, more and more seniors require long-term healthcare services in nursing homes and assisted living facilities. However, such care is extremely expensive, especially when it’s needed for extended periods of time. Traditional...