by Trust Counsel | Oct 13, 2023 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Guardianship, Incapacity, Income Tax, Kids Protection Planning, Non - US Citizen, Non-Probate Asset, Probate, Probate Litigation, Real Property / Real Estate, Trusts, Uncategorized, Wills

It might seem a bit early to think about your 2023 taxes, but as the year draws to a close, it’s the perfect time to take a closer look at your financial situation and make some strategic moves that can help you minimize your tax liability come April. Year-end...

by Trust Counsel | Oct 6, 2023 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Guardianship, Health Care Directive, Kids Protection Planning, Non - US Citizen, Non-Probate Asset, Probate, Probate Litigation, Real Property / Real Estate, Special Needs Planning, Trusts, Uncategorized, Wills

The fall season is a beautiful time of year, but it also marks the beginning of flu season, which can pose a serious threat to your elderly loved ones. Fortunately, there are several steps you can take to ensure their well-being during the colder days ahead, including...

by Trust Counsel | Sep 29, 2023 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Guardianship, Income Tax, Intellectual Property, Kids Protection Planning, Non - US Citizen, Non-Probate Asset, Probate, Probate Litigation, Special Needs Planning, Trusts, Uncategorized, Wills

As a parent, you have probably thought about the importance of naming permanent legal guardians for your child in case something happens to you, and maybe you have already done it. If you haven’t yet, take this as the sign that now’s the time to do it, in case the...

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

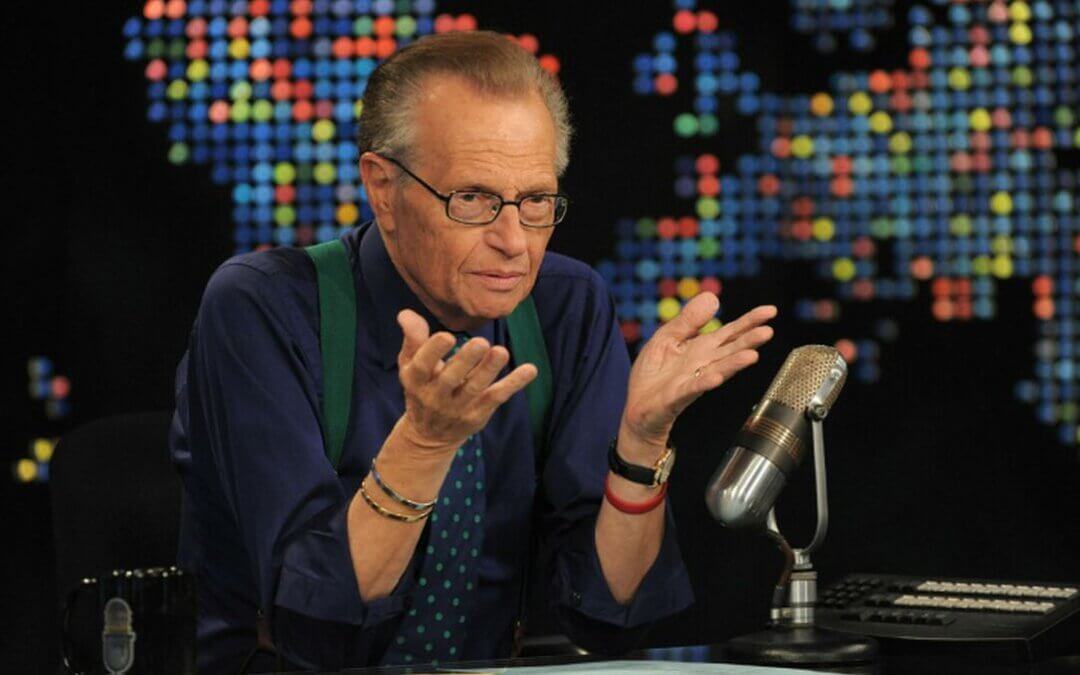

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...

by Trust Counsel | Dec 11, 2020 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, Kids Protection Planning, Liens/Debt, Non - US Citizen, Non-Probate Asset

Since you’ll be discussing topics like death, incapacity, and other frightening life events, hiring an estate planning lawyer may feel intimidating or morbid. But it definitely doesn’t have to be that way. Instead, it can be the most empowering decision you ever make...

by Trust Counsel | Nov 27, 2020 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Kids Protection Planning, Liens/Debt, Non - US Citizen, Non-Probate Asset, Probate, Probate Litigation, Real Property / Real Estate, Retirement, Special Needs Planning, Trusts, Vacation / Travel, Wills

Today, we’re seeing more and more people getting divorced in middle age and beyond. Indeed, the trend of couples getting divorced after age 50 has grown so common, it’s even garnered its own nickname: “gray divorce.” Today, roughly one in four divorces involve those...