by Trust Counsel | Nov 17, 2023 | Articles, Asset Protection, Family, Financial, IRAs / 401(k), Retirement, Special Needs Planning, Uncategorized, Wills

This week, I explain how the law affects retirement distributions for married couples, and why you need to be extra careful with your retirement planning if you’re part of a blended family. Read more… What You Must Know About Your Right to Your Spouse’s Retirement...

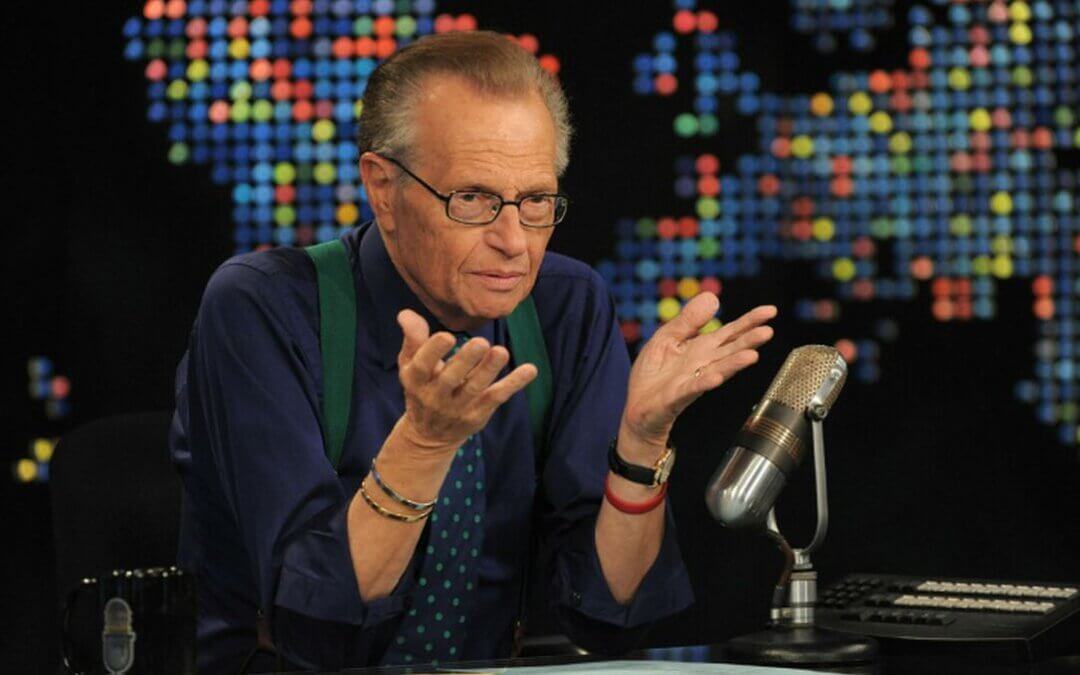

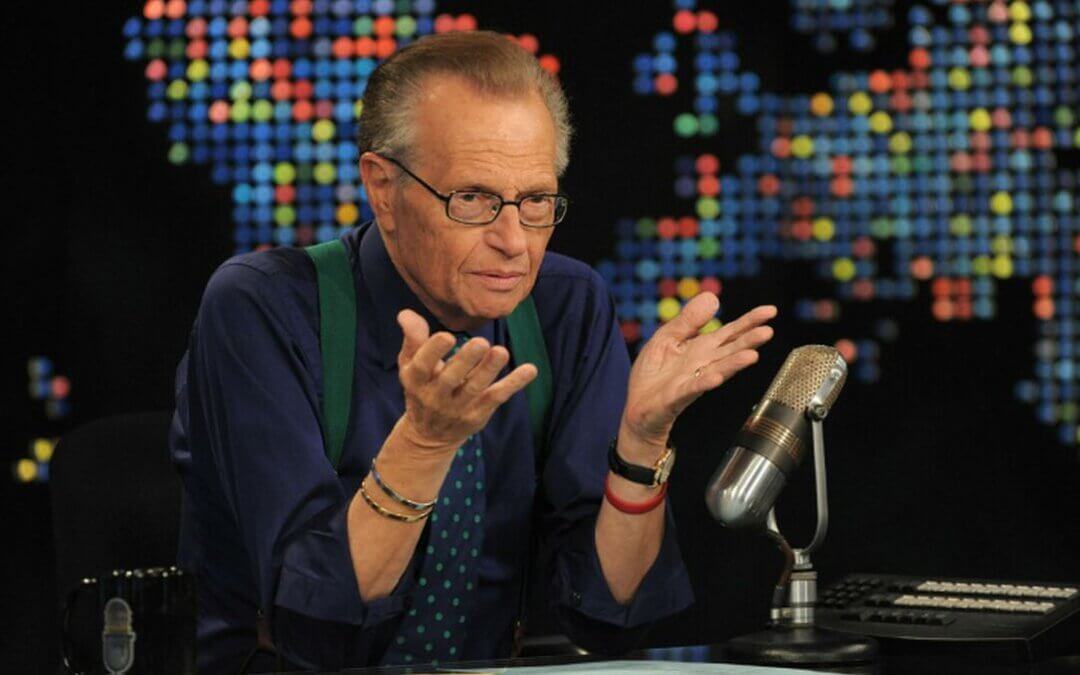

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...

by Trust Counsel | Jan 15, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Kids Protection Planning

With people living longer than ever before, more and more seniors require long-term healthcare services in nursing homes and assisted living facilities. However, such care is extremely expensive, especially when it’s needed for extended periods of time. Traditional...

by Trust Counsel | Dec 4, 2020 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Kids Protection Planning, Liens/Debt, Podcast, Probate, Probate Litigation, Real Property / Real Estate, Retirement, Special Needs Planning, Trusts, Vacation / Travel, Wills

Since you’ll be discussing topics like death, incapacity, and other frightening life events, hiring an estate planning lawyer may feel intimidating or morbid. But it definitely doesn’t have to be that way. Instead, it can be the most empowering decision you ever make...

by Trust Counsel | Nov 27, 2020 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Kids Protection Planning, Liens/Debt, Non - US Citizen, Non-Probate Asset, Probate, Probate Litigation, Real Property / Real Estate, Retirement, Special Needs Planning, Trusts, Vacation / Travel, Wills

Today, we’re seeing more and more people getting divorced in middle age and beyond. Indeed, the trend of couples getting divorced after age 50 has grown so common, it’s even garnered its own nickname: “gray divorce.” Today, roughly one in four divorces involve those...

by Trust Counsel | Nov 25, 2020 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Kids Protection Planning, Liens/Debt, Non - US Citizen, Podcast, Probate, Probate Litigation, Real Property / Real Estate, Retirement, Scams, Trusts

A will is one of the most basic estate planning tools. While relying solely on a will is rarely a suitable option for most people, just about every estate plan includes this key document in one form or another. A will is used to designate how you want your assets...