by Trust Counsel | Sep 9, 2022 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Financial, Income Tax, Real Property / Real Estate

If you have a sale of real estate or assets coming up that will result in you owing capital gains tax, you may want to give us a call to discuss whether to set up a Charitable Remainder Trust (CRT) first. Think of it this way: would you rather pay taxes and send your...

by Trust Counsel | Jul 8, 2022 | Articles, Asset Protection, Business/ Corporate Law, Estate Planning, Family, Inheritance, Trusts, Wills

If you’re looking to collect life insurance proceeds as the policy’s beneficiary, the process is fairly simple. However, during the emotional period immediately following a loved one’s death, it can feel as if your entire world is falling apart, so it’s helpful...

by Trust Counsel | Feb 13, 2022 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Estate Tax

If you are running a business, it’s easy to give estate planning less priority than your other business matters. After all, if you’re facing challenges meeting next month’s payroll or your goals for growth over the coming quarter, concerns over your potential...

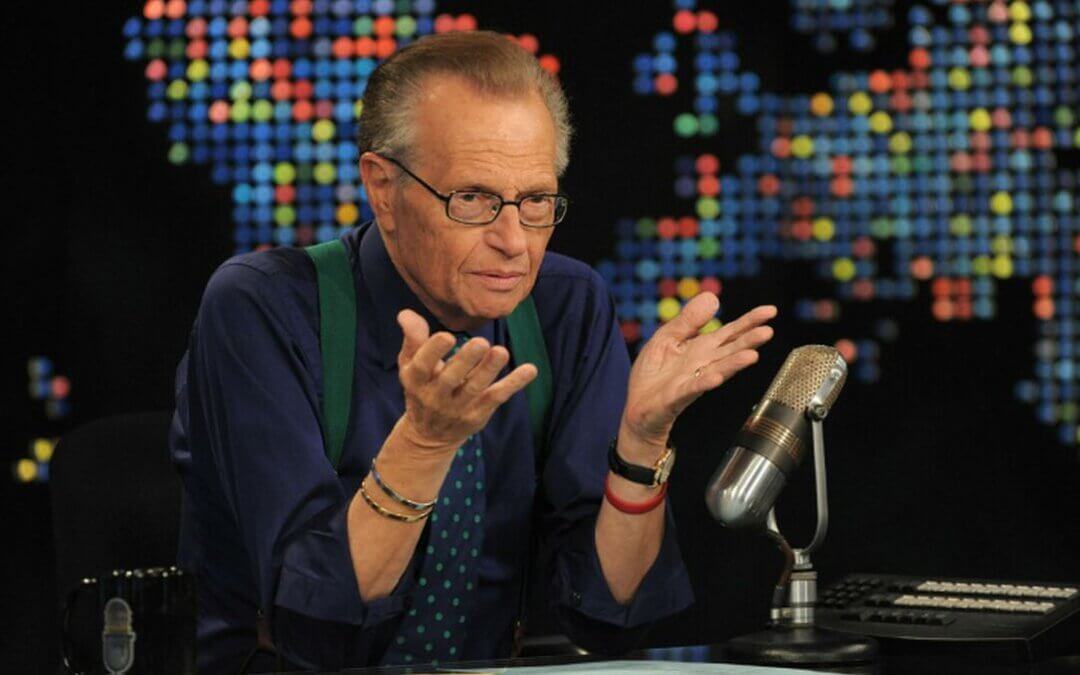

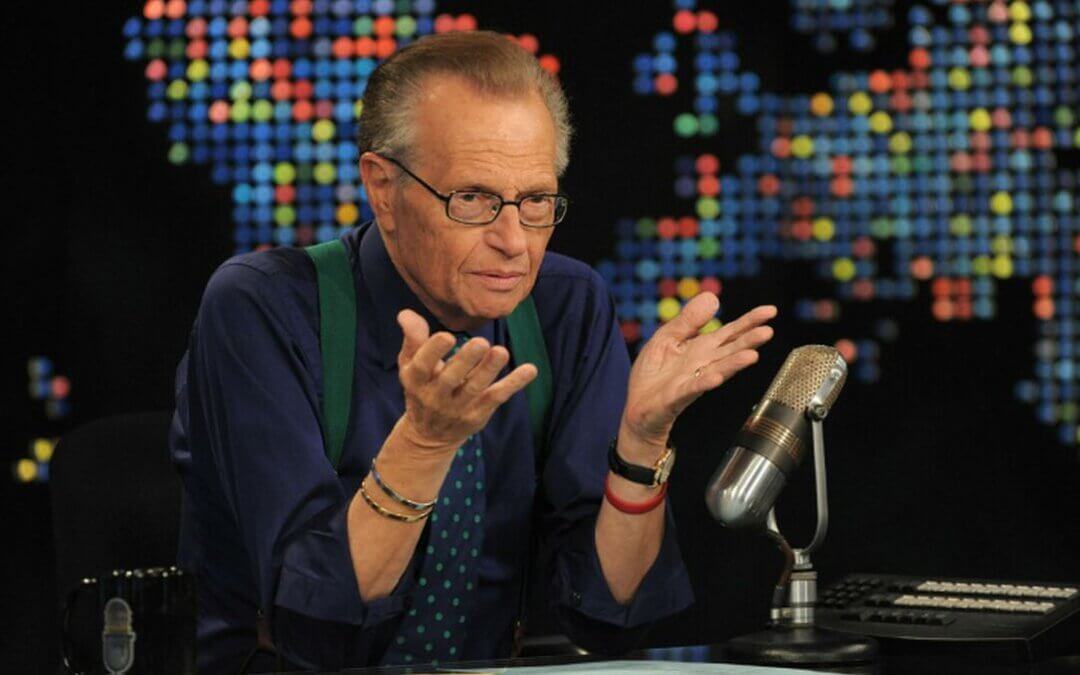

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...

by Trust Counsel | Feb 11, 2021 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Family, Financial, Guardianship, Health Care Directive, Income Tax, Inheritance

This week’s pandemic guilty-pleasure television takes a more serious look at the butt of our collective joke: Britney Spears, her 2007 breakdown, and the decade-plus control her father has exercised over her life and finances thanks to a conservatorship proceeding....

by Trust Counsel | Feb 5, 2021 | Articles, Asset Protection, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Inheritance, Intellectual Property, Kids Protection Planning, Liens/Debt, Trusts, Wills

Within the past year, a combination of new legislation and the recent change of leadership in the White House and Congress stands to dramatically increase the income taxes your loved ones will have to pay on inherited retirement accounts as well as increasing the...