by Trust Counsel | Sep 9, 2022 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Financial, Income Tax, Real Property / Real Estate

If you have a sale of real estate or assets coming up that will result in you owing capital gains tax, you may want to give us a call to discuss whether to set up a Charitable Remainder Trust (CRT) first. Think of it this way: would you rather pay taxes and send your...

by Trust Counsel | Aug 21, 2022 | Articles, Asset Protection, Business Succession, Estate Planning, Family, Financial, Inheritance

August is “National Make-A-Will Month,” and if you have already prepared your will, congratulations—too few Americans have taken this key first step in the estate planning process. In fact, only 33% of Americans have created their will, according to Caring.com’s 2022...

by Trust Counsel | Jul 15, 2022 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial

Despite the fact that it happens to every single one of us and is as every bit as natural as birth, very few among us are properly prepared for death—whether our own death or the death of a loved one. Yet the pandemic might be changing this. According to Census...

by Trust Counsel | Feb 13, 2022 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Estate Tax

If you are running a business, it’s easy to give estate planning less priority than your other business matters. After all, if you’re facing challenges meeting next month’s payroll or your goals for growth over the coming quarter, concerns over your potential...

by Trust Counsel | Dec 17, 2021 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Trusts, Wills

As you likely already know, but may not have given much thought about, the most important inheritance you provide is so much more than the money you’ll leave behind, but also includes your values, insights, stories, and experience. And, while those things are being...

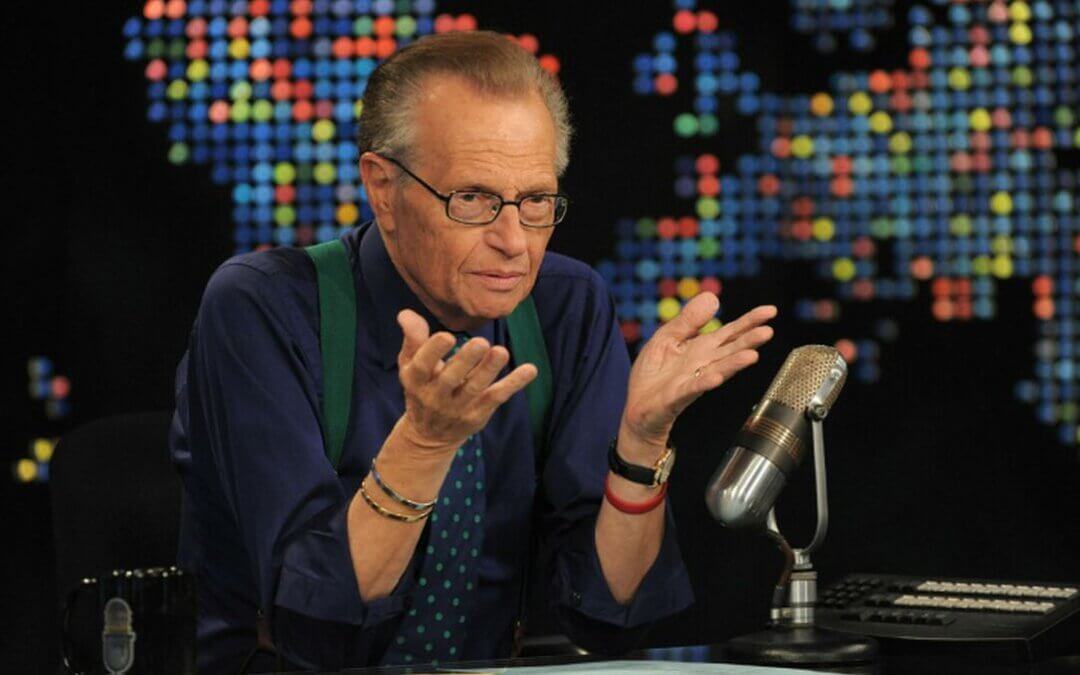

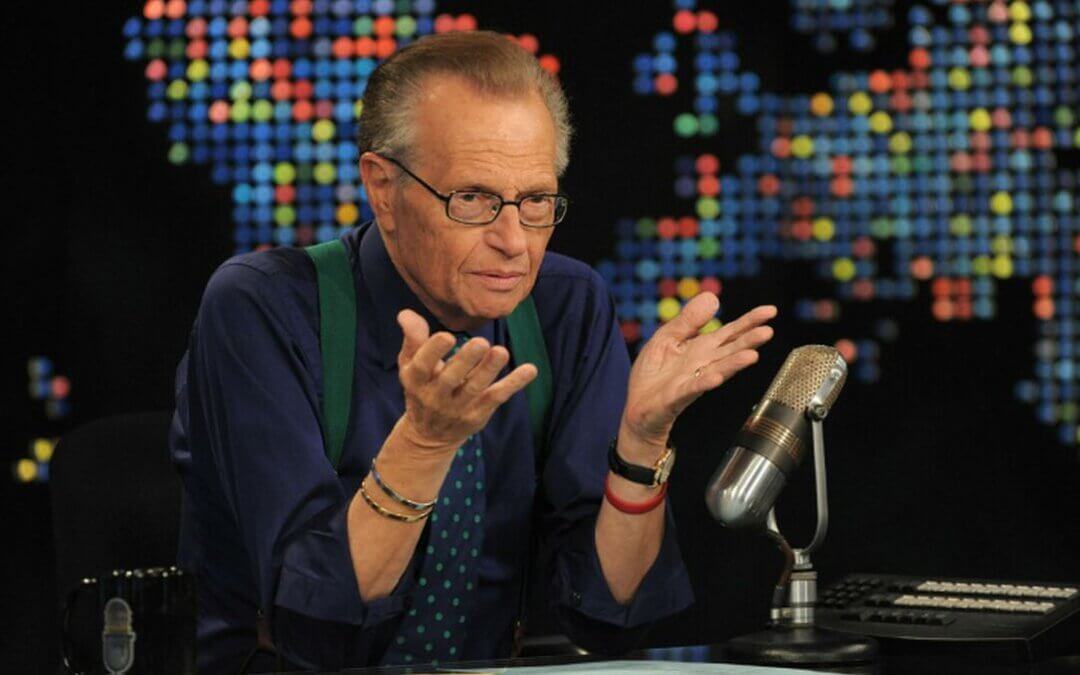

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...