by Trust Counsel | Sep 25, 2020 | Estate Planning, Inheritance, Trusts, Wills

While estate planning is probably one of the last things your teenage kids are thinking about, given the dire threat coronavirus represents, when they turn 18, it should be their (and your) number-one priority. Here’s why: At 18, they become legal adults in the eyes...

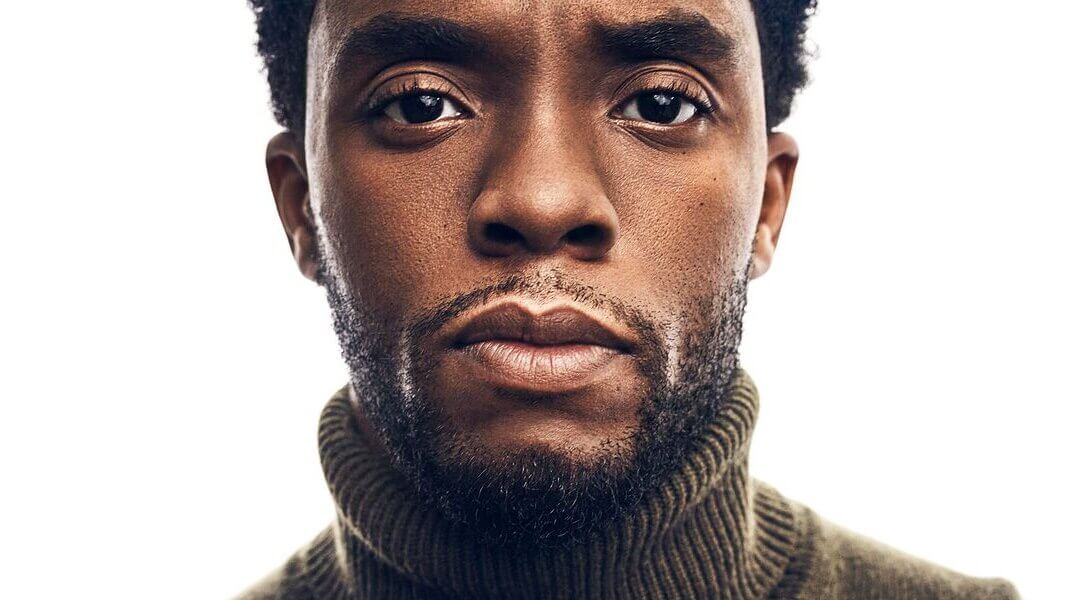

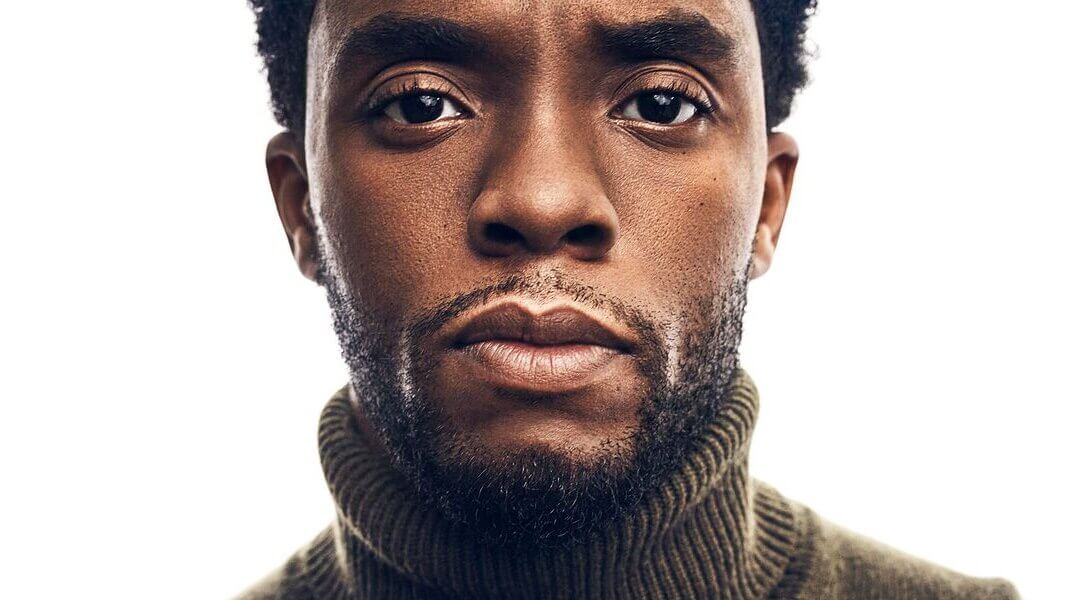

by Trust Counsel | Sep 2, 2020 | Articles, Asset Protection, Celebrity Estates, Estate Planning, Estate Tax, Family, Trusts, Wills

As I am sure you have heard, Actor Chadwick Boseman, best known for playing Black Panther in the hit Marvel superhero franchise, died of cancer at the very young age of 43 last week. Since I had not seen it before, over the weekend I saw the Marvel smash hit everyone...

by Trust Counsel | Aug 10, 2020 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial, Trusts, Wills

Anyone who has seen the hit Netflix documentary Tiger King: Murder, Mayhem, and Madness can attest that it’s one of the most outlandish stories to come out in a year full of outlandish stories. And while Tiger King’s sordid tale of big cats, murder-for-hire, polygamy,...

by Trust Counsel | Jul 13, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Financial, Inheritance, Trusts, Wills

When Chanel’s creative director Karl Lagerfeld passed away in 2019, rumors went wild about who would inherit his $270 million estate. Many of those rumors claimed that he wanted his Birman cat, Choupette, to get it all. A year later, we’re still waiting to get the...

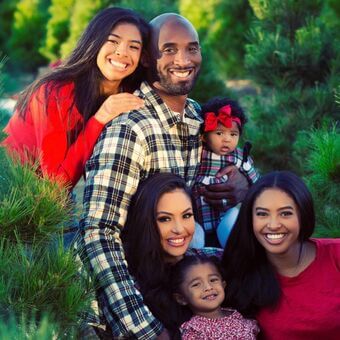

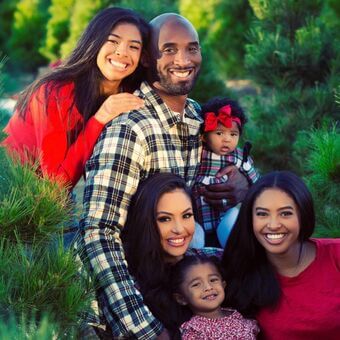

by Trust Counsel | Jul 8, 2020 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial, Trusts, Wills

In January, we reported how the deaths of NBA legend Kobe Bryant (Kobe) and his 13-year-old daughter, Brianna, in a helicopter crash demonstrated the vital need for estate planning for people of all ages. At the time, little was known about the planning strategies...

by Trust Counsel | Jun 26, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Trusts, Wills

If you have a blended family and do not plan for what happens to your assets in the event of your incapacity or eventual death, you are almost certainly guaranteeing hurt feelings, conflict, and maybe even a long, drawn out court battle. So let’s start with clarity...