by Trust Counsel | Apr 8, 2024 | Articles, Asset Protection, Business Succession, Celebrity Estates, Estate Planning, Family, High Net Worth, Inheritance

Gabrielle Chanel, born in 1883, embarked on a legendary journey from orphan to global fashion icon. Yet, even for someone of immense wealth like Chanel, her legacy was not immune to the complexities of estate planning. From The Little Black Dress to the Chanel Suit,...

by Trust Counsel | Apr 5, 2024 | Articles, Business Succession, Estate Planning, Family, Financial, High Net Worth

In an era where digital innovation shapes every aspect of our lives, it’s no surprise that our teenagers are drawn to the allure of cryptocurrency. This digital form of money represents a shift away from traditional financial systems. If you are the parent of...

by Trust Counsel | Mar 15, 2024 | Articles, Asset Protection, Business Succession, Estate Planning, Financial, High Net Worth, Inheritance, Trusts, Wills

Selecting the individual to lead your business after you step down is a huge decision. It’s not merely about finding someone who mirrors your personality or whom you favor personally. Rather, the crux lies in identifying a successor who possesses the right...

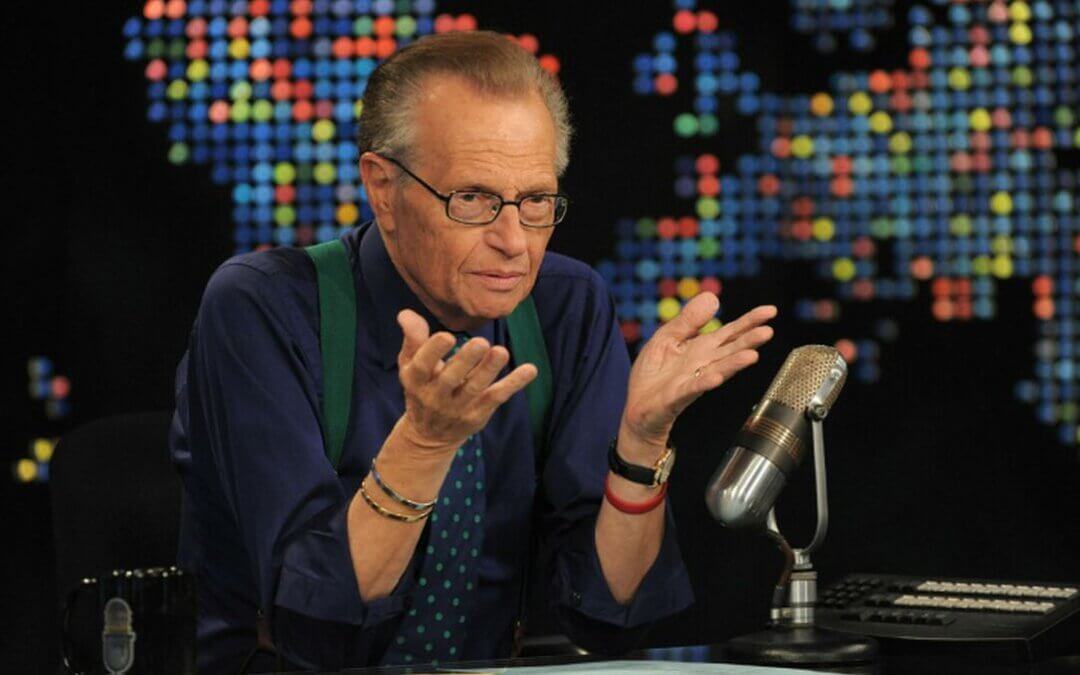

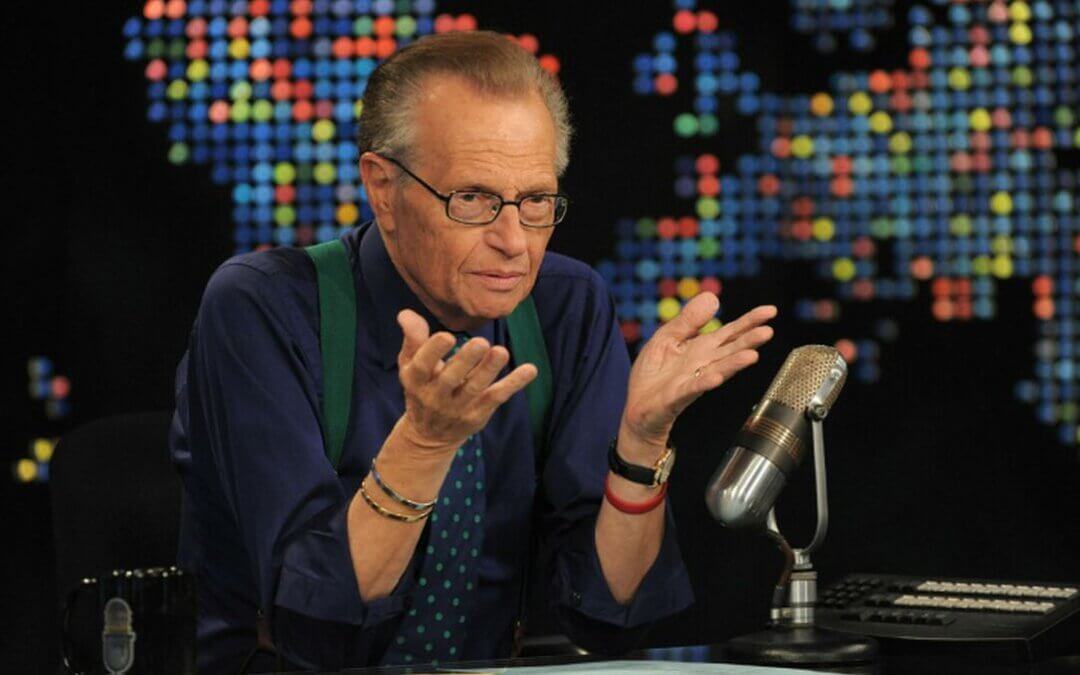

by Trust Counsel | Feb 12, 2021 | Asset Protection, Business Succession, Business/ Corporate Law, Case Law, Celebrity Estates, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Incapacity, Income Tax, Inheritance, Intellectual Property, IRAs / 401(k), IRS, Liens/Debt, Non - US Citizen, Non-Probate Asset

News icon Larry King recently passed away in the midst of his eighth divorce. We will remember his many memorable interviews and nearly as many trips to the altar. He brought the famous and influential into our homes for decades, and those interviews bridge eras and...

by Trust Counsel | Feb 5, 2021 | Articles, Asset Protection, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Financial, Gift Tax, Guardianship, Health Care Directive, High Net Worth, Inheritance, Intellectual Property, Kids Protection Planning, Liens/Debt, Trusts, Wills

Within the past year, a combination of new legislation and the recent change of leadership in the White House and Congress stands to dramatically increase the income taxes your loved ones will have to pay on inherited retirement accounts as well as increasing the...

by Trust Counsel | Feb 4, 2021 | Articles, Asset Protection, Business Succession, Case Law, Celebrity Estates, Estate Planning, Family, Financial, High Net Worth, Incapacity, Income Tax, Inheritance, Kids Protection Planning, Liens/Debt, Retirement, Wills

It may seem like a distant memory due to more recent events, a pandemic, and a presidential election, but it has only been ONE year since NBA legend Kobe Bryant and his 13-year-old daughter, Gianna (“Gigi”), tragically passed away in a helicopter crash in Calabasas,...