by Trust Counsel | Feb 7, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Inheritance, Wills

A last will and testament can ensure your wishes are respected when you die. But if your will isn’t legally valid, those wishes might not actually be carried out, and instead the laws of “intestate succession” would apply, meaning that the state decides who gets your...

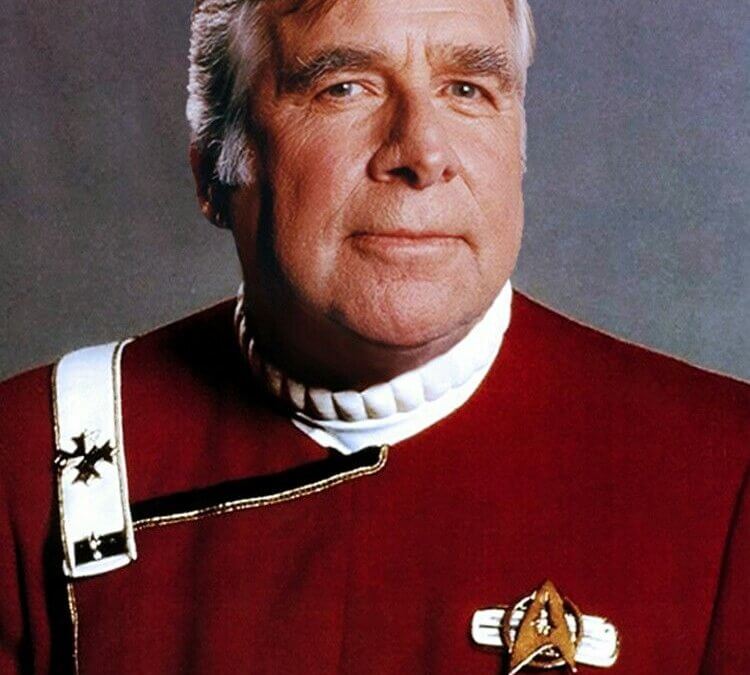

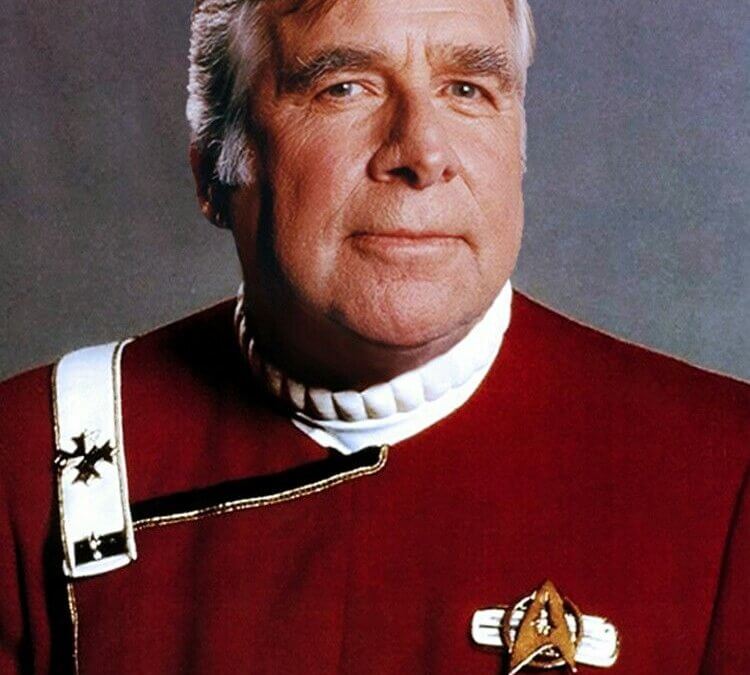

by Trust Counsel | Jan 30, 2020 | Articles, Asset Protection, Celebrity Estates, Estate Planning, Estate Tax, Financial, Trusts, Wills

When it comes to creative thinking, some famous folks seem to operate well outside the norm. Such is often the case for science fiction screenwriters and producers, who summon from their imagination’s visions of the distant future. These creatives have brought eager...

by Trust Counsel | Jan 10, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Inheritance, Trusts, Wills

The Tax Cuts & Jobs Act (TCJA) made sweeping changes to exemptions, deductions, and credits for your family’s federal income taxes. But one major change that you might not have noticed is the way the law altered the potential tax consequences of divorce. Unlike...

by Trust Counsel | Jan 2, 2020 | Articles, Estate Planning, Estate Tax, Family, High Net Worth, Inheritance, Trusts, Wills

There are many good reasons to create an estate plan early in life. But not very many people do. Statistics show that most American adults – about 55% – don’t even have a signed Will, much less an estate plan; most of these folks are young. There are all kinds...

by Trust Counsel | Nov 1, 2019 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Estate Planning, Estate Tax, Family, Income Tax, Trusts

As we head towards the end of the year, we’re fast approaching the deadline to implement your family’s tax strategies for 2019. The Tax Cut and Jobs Act (TCJA) completely overhauled the tax code, and if you’ve yet to take full advantage of the benefits offered by the...

by Trust Counsel | Oct 31, 2019 | Articles, Asset Protection, Business Succession, Business/ Corporate Law, Celebrity Estates, Estate Planning, Estate Tax

When Leona Helmsley died, she left her pet Maltese, named Trouble, a trust fund valued at $12 million dollars. That made Trouble the third wealthiest dog in the world at the time (the top spot goes to Gunther III, Countess Karlotta Libenstein’s German Shepherd, who...