by Trust Counsel | Aug 13, 2020 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial

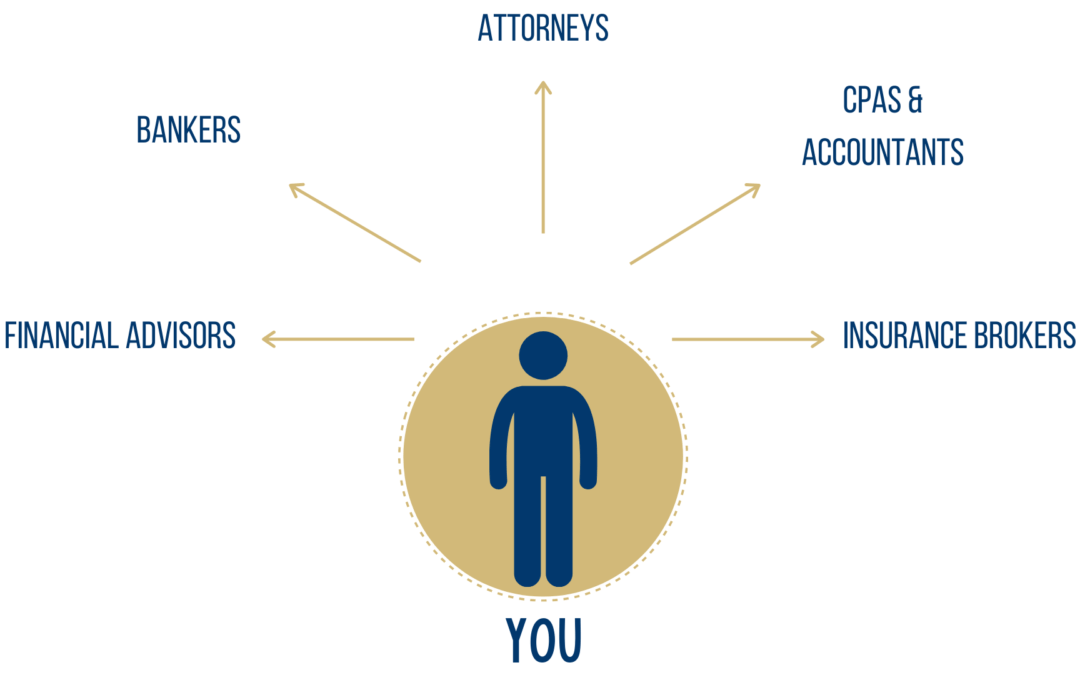

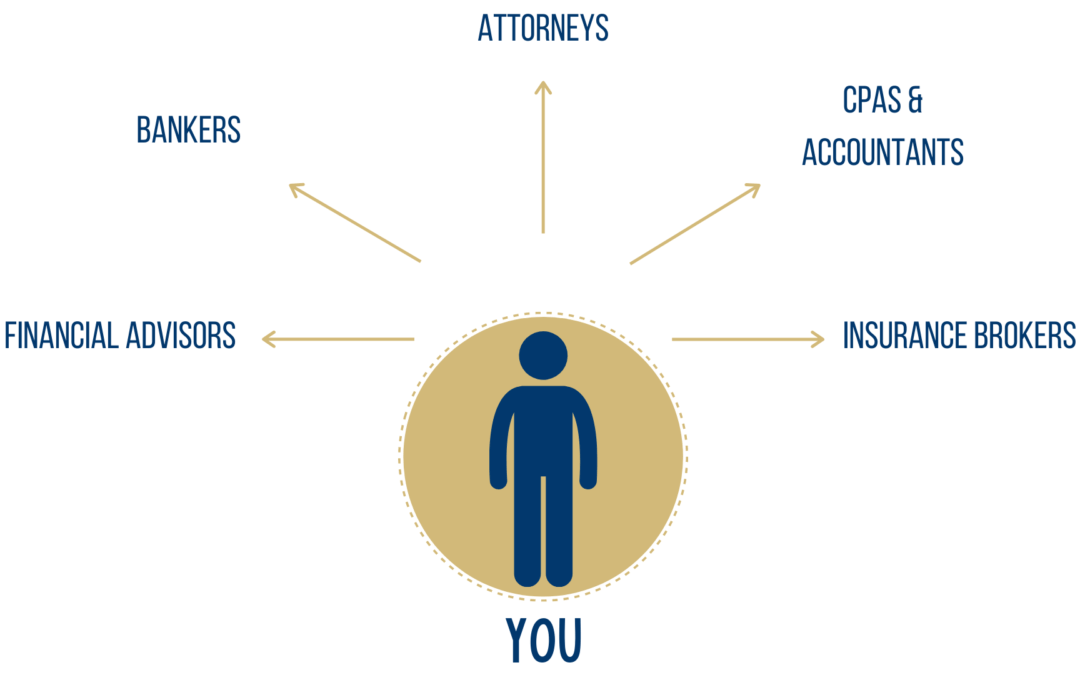

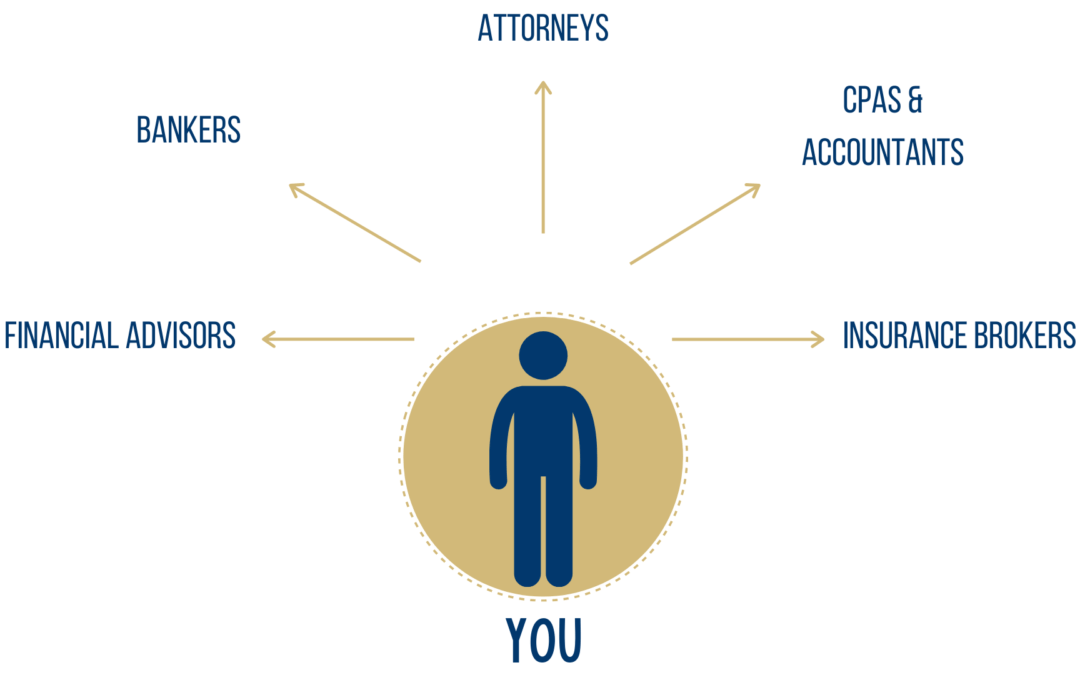

I am always preaching that there are 5 people you want on your side when building your family’s trusted advisory team: 1) Attorney, 2) Accountant, 3) Insurance Advisor, 4) Financial Advisor, and 5) Banker. Your personal financial dream team will help you navigate the...

by Trust Counsel | Aug 10, 2020 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial, Trusts, Wills

Anyone who has seen the hit Netflix documentary Tiger King: Murder, Mayhem, and Madness can attest that it’s one of the most outlandish stories to come out in a year full of outlandish stories. And while Tiger King’s sordid tale of big cats, murder-for-hire, polygamy,...

by Trust Counsel | Aug 3, 2020 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial

If you are engaged to be married, divorce is probably the last thing you and your fiancé want to be thinking about. Yet you might be rightfully concerned about what would happen to your assets should your marriage end in divorce or in the event of your death. One...

by Trust Counsel | Jul 27, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Financial

If you’re counting down the days to your wedding, divorce is probably the last thing you and your fiancé want to be thinking about, and yet you might be rightfully concerned about what would happen to your assets in the event of a divorce—or your death. You may also...

by Trust Counsel | Jul 13, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Financial, Inheritance, Trusts, Wills

When Chanel’s creative director Karl Lagerfeld passed away in 2019, rumors went wild about who would inherit his $270 million estate. Many of those rumors claimed that he wanted his Birman cat, Choupette, to get it all. A year later, we’re still waiting to get the...

by Trust Counsel | Jul 8, 2020 | Articles, Asset Protection, Business Succession, Estate Planning, Estate Tax, Family, Financial, Trusts, Wills

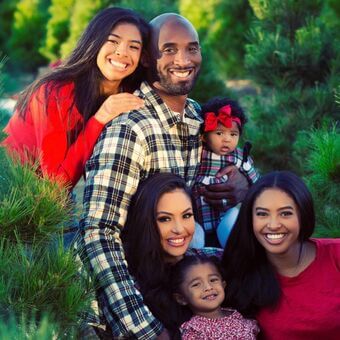

In January, we reported how the deaths of NBA legend Kobe Bryant (Kobe) and his 13-year-old daughter, Brianna, in a helicopter crash demonstrated the vital need for estate planning for people of all ages. At the time, little was known about the planning strategies...