by Trust Counsel | Mar 13, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Trusts, Wills

Do your parents have an estate plan? Is it up to date? No matter how rich or poor you or your parents are, especially in the wake of the COVID-19 pandemic, you need to be asking these and several other questions. When your parents become incapacitated or die, their...

by Trust Counsel | Feb 13, 2020 | Articles, Celebrity Estates, Estate Planning, Estate Tax, Family, Trusts, Wills

Kobe Bryant achieved both fame and fortune as an NBA superstar, businessman, family man, and citizen of the world. The news of his tragic death in a fiery helicopter crash in January has left his many fans and admirers stunned and deeply saddened. As the world mourns...

by Trust Counsel | Feb 7, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Inheritance, Wills

A last will and testament can ensure your wishes are respected when you die. But if your will isn’t legally valid, those wishes might not actually be carried out, and instead the laws of “intestate succession” would apply, meaning that the state decides who gets your...

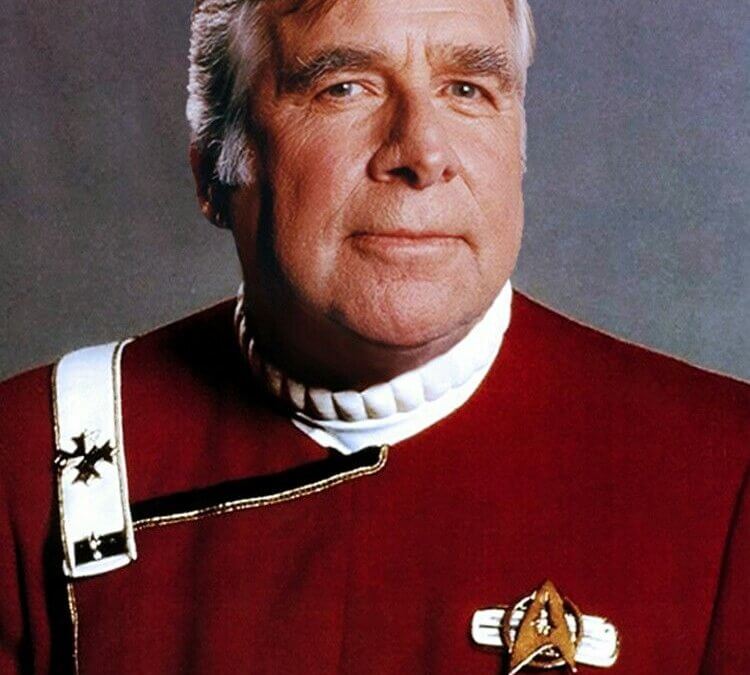

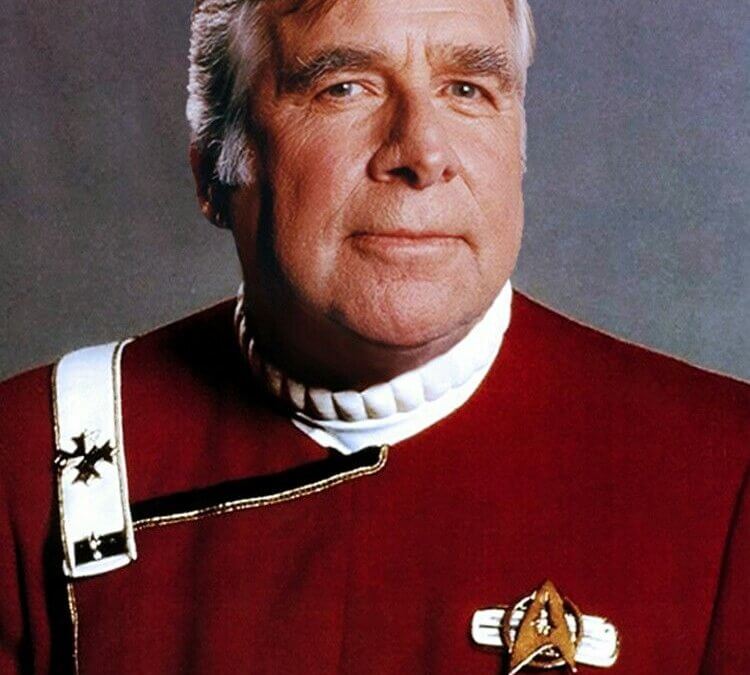

by Trust Counsel | Jan 30, 2020 | Articles, Asset Protection, Celebrity Estates, Estate Planning, Estate Tax, Financial, Trusts, Wills

When it comes to creative thinking, some famous folks seem to operate well outside the norm. Such is often the case for science fiction screenwriters and producers, who summon from their imagination’s visions of the distant future. These creatives have brought eager...

by Trust Counsel | Jan 24, 2020 | Articles, Asset Protection, Estate Planning, Trusts, Wills

Both wills and trusts are estate planning documents that can be used to pass your wealth and property to your loved ones upon your death. However, trusts come with some distinct advantages over wills that you should consider when creating your plan. That said, when...

by Trust Counsel | Jan 17, 2020 | Articles, Asset Protection, Estate Planning, Family, Financial, Inheritance, Trusts, Wills

In the first part of this series, we discussed the potential ramifications the SECURE ACT has for your estate and retirement planning. Here, we’ll look more deeply into additional strategies you may want to consider in light of the new legislation. To see the...