by Trust Counsel | Mar 13, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Trusts, Wills

Do your parents have an estate plan? Is it up to date? No matter how rich or poor you or your parents are, especially in the wake of the COVID-19 pandemic, you need to be asking these and several other questions. When your parents become incapacitated or die, their...

by Trust Counsel | Feb 24, 2020 | Articles, Estate Planning

What Happens to Your Pets When You Die? If you have pets, my guess is that you love them as much as you do your children, but I’m also guessing that you have not provided any written or, better yet, legally documented instructions about what should happen to them, if...

by Trust Counsel | Feb 14, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Financial, Kids Protection Planning

In many families, money still is not a typical dinner table discussion, but we think it should be. Surprisingly, this is especially true when it comes to affluent parents. And, we hope to change it because one of the most important things you can do is talk to your...

by Trust Counsel | Feb 13, 2020 | Articles, Celebrity Estates, Estate Planning, Estate Tax, Family, Trusts, Wills

Kobe Bryant achieved both fame and fortune as an NBA superstar, businessman, family man, and citizen of the world. The news of his tragic death in a fiery helicopter crash in January has left his many fans and admirers stunned and deeply saddened. As the world mourns...

by Trust Counsel | Feb 7, 2020 | Articles, Asset Protection, Estate Planning, Estate Tax, Family, Inheritance, Wills

A last will and testament can ensure your wishes are respected when you die. But if your will isn’t legally valid, those wishes might not actually be carried out, and instead the laws of “intestate succession” would apply, meaning that the state decides who gets your...

by Trust Counsel | Feb 4, 2020 | Articles, Asset Protection, Estate Planning, Financial

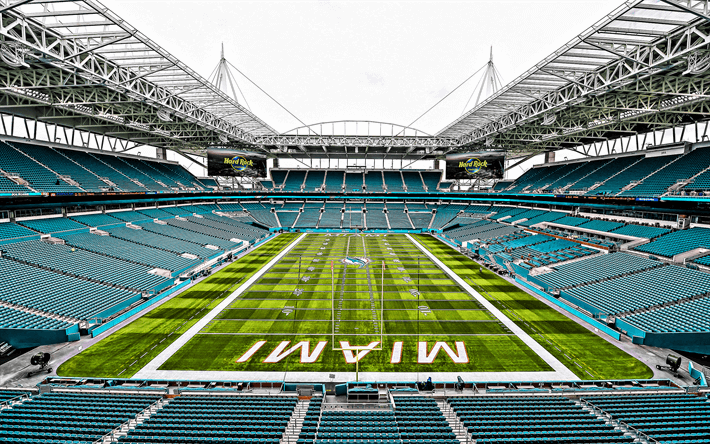

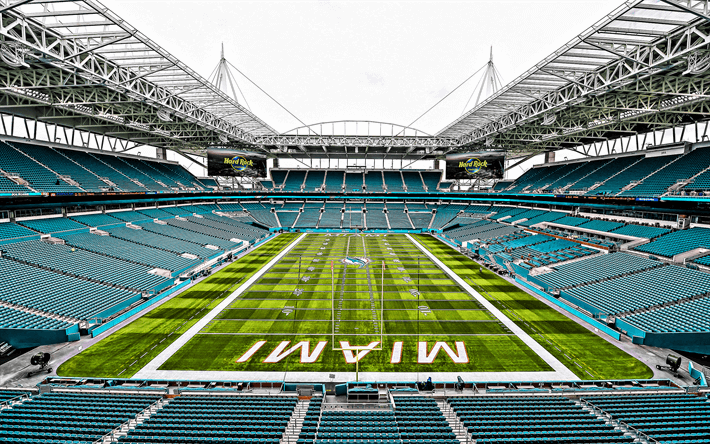

Most of us watched the Super Bowl this weekend, which was played at the Hard Rock Stadium but if you have lived in Miami since the 90’s you probably still call that venue The Joe Robbie Stadium. When the stadium went up in the late ‘80s, it was named after the founder...