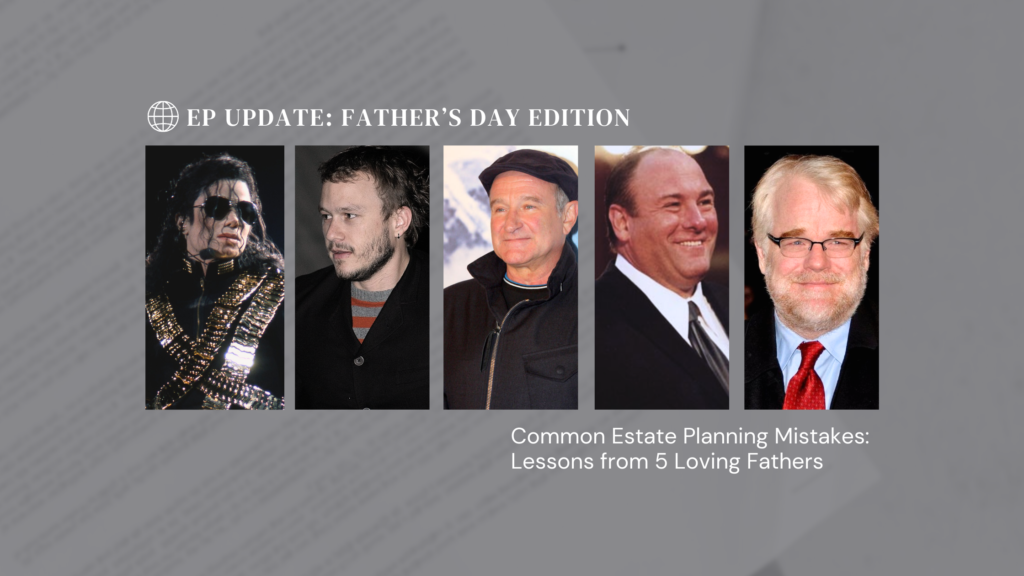

As Father’s Day approaches, we reflect on the importance of protecting all assets through careful estate planning. Today, we delve into the stories of five legendary fathers: Michael Jackson, Heath Ledger, Robin Williams, James Gandolfini, and Philip Seymour Hoffman.

These celebrities, though devoted to their families, made estate planning mistakes that left their loved ones facing significant challenges. Join us as we explore their legal battles and the lessons they impart on the significance of comprehensive estate planning.

Michael Jackson: The King of Pop and His Frozen Trust

Michael Jackson’s untimely death in 2009 led to a series of legal disputes over his estate. Recently, the IRS has frozen his trust due to unresolved tax issues, leaving his family unable to access the funds.

The ongoing dispute between Jackson’s estate and the IRS highlights the importance of clear and thorough estate planning to avoid tax complications and ensure that beneficiaries can access their inheritance without delays.

Learn more about this case here.

Heath Ledger: The Unforeseen Impact of an Outdated Will

Heath Ledger, best known for his role as the Joker in “The Dark Knight,” passed away unexpectedly in 2008. Despite having a will, it was outdated and did not account for his daughter, Matilda, who was born after the will was written. As a result, his estate was initially set to go entirely to his parents and siblings, creating potential conflicts and complications.

Learn more about this case here.

Robin Williams: The Beloved Comedian and His Disputed Estate

Robin Williams, renowned for his comedic genius and acting talent, passed away in 2014. Despite his efforts to provide for his family, his estate planning left room for disputes.

Williams had set up trusts for his children and a separate provision for his third wife, Susan Schneider Williams, but ambiguities in the wording of the documents led to disputes over personal belongings and financial support.

Learn more about this case here.

James Gandolfini: Estate Taxes and Poor Planning

James Gandolfini, famous for his role in “The Sopranos,” passed away in 2013. Although he had a will, he did not account for the high estate taxes his heirs would face. Approximately 55% of his $70 million estate was lost to estate taxes, significantly reducing the inheritance for his loved ones.

Learn more about this case here.

Philip Seymour Hoffman: A Trusting Father’s Misstep

Philip Seymour Hoffman, an Oscar-winning actor, died in 2014. He left his entire estate to his longtime partner, Mimi O’Donnell, bypassing his three children. Hoffman believed this would simplify things, but it led to unintended tax consequences and potential future disputes among his children.

Learn more about this case here.

What Estate Planning Lessons Can We Learn from The Mistakes of These Loving Parents?

- Be Prepared for Taxes: Understand that estate taxes can significantly reduce the wealth you pass on to your heirs. Proper planning can help mitigate these taxes.

- Regularly Update Your Estate Plan: Major life changes, such as the birth of a child or a significant increase in wealth, should prompt an update to your estate plan.

- Create a Will: While a simple will can express your wishes, it may not prevent probate. However, it’s a crucial step in outlining your desires and guiding asset distribution.

- Use Trusts Wisely: Trusts can protect your assets from taxes and legal disputes, ensuring they are passed on according to your wishes.

- Seek Professional Guidance: Consult with estate planning attorneys and tax advisors to create a comprehensive plan that addresses all potential issues.

How Trust Counsel Can Help

Don’t let your legacy be clouded by poor planning. At Trust Counsel, we specialize in crafting comprehensive estate plans that protect your assets and provide for your loved ones.

Our team can help you navigate the complexities of estate planning, ensuring that your family is taken care of and your wishes are honored, schedule an Initial assessment call with us now!