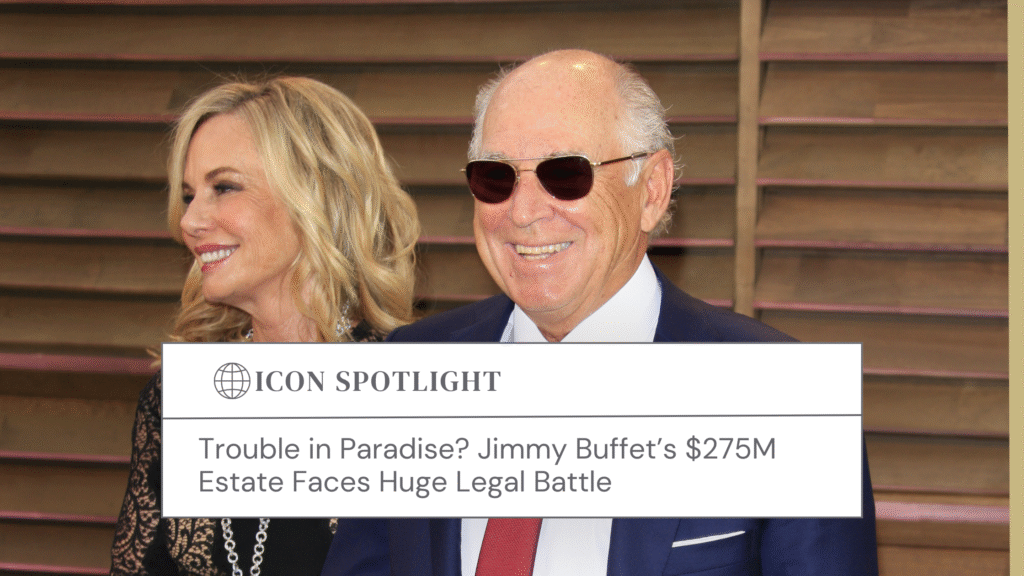

“Margaritaville”: a concept, a song, and eventually, a huge company of restaurants, resorts, and cruise ships. Unfortunately, the laid-back, “chill” factor that is an iconic part of the brand, and by extension, the legacy of Jimmy Buffett, the late singer, author, and businessman behind the concept of “Margaritaville”, is being faced with trouble. The issue? His $275 million estate is the subject of a contentious legal battle between Jane Buffett, his surviving spouse, and Richard Mozenter, Mr. Buffett’s friend and financial advisor. Not only is this battle the result of ongoing tensions between Mozenter and Mrs. Buffett, but it’s also a great source of important estate planning lessons, both of which we’ll very gladly cover here.

But First… Some Key Context

Prior to passing away, Jimmy Buffett had established a number of trusts, along with a will, establishing how the assets in his estate would be distributed to his family. One such trust is the marital trust he set up for his wife, Jane, intended to give her financial security after his passing. The trust includes not only several of Buffett’s properties, acquired during the course of his lifetime, but also has 20% ownership of Margaritaville Holdings, LLC., including all casinos, cruises, vacation clubs, hotels, and restaurants under the brand’s name. Despite the fact that Mrs. Buffett is the sole beneficiary of this trust, her, along with Richard Mozenter, were actually listed as co-trustees. This meant that they had an equal fiduciary duty, or legal obligation, to manage and administer Buffett’s estate.

How Did This Lead to A Legal Battle?

Well, this is where the problem really began, according to Mrs. Buffett’s petition against Mozenter. She claims that, about a month after her husband passed, she asked Mozenter, as co-trustee, for an estimate of what she could expect to receive from the trust moving forward in an effort to “understand her finances”. However, it took Mozenter about 16 months to give her an answer at all, and when he did, his estimates forecasted that she would only get a little less than $2 million every year, which she felt was “shocking”, considering that, in the past 18 months alone, Margaritaville made $14 million. Not only did he refuse to add any estimates of future revenue to the amount he gave Mrs. Buffett, but Mrs. Buffett’s counsel argued that, even if his estimates were correct, this would mean that Mozenter is “not competent” to administer Mr. Buffett’s estate. This, along with claims that he is transferring properties in New York, Florida, and St. Barts that were meant to stay in Jane’s possession, are listed as reasons by Mrs. Buffet’s counsel for Mozenter being removed as co-trustee.

That being said, there is another side to this story: Richard “Ricky” Mozenter had asked Mrs. Buffett to retain Jeffrey Smith as their counsel. Jeffrey Smith, in the course of his work, seems to provide a completely different outlook on the situation. He claims Jane Buffett is breaching her fiduciary duty to the estate by negotiating deals with late Mr. Buffett’s music producer Irving Azoff to make a documentary about her late husband. The petition Mrs. Buffett filed with the court also alleges that he threatened to investigate what he believes to be defamation of Mozenter.

So, What’s Next? And How Does This Apply to You?

Exactly what is going to occur with either Mrs. Buffett or Mozenter in terms of their titles as co-trustee has yet to be determined, but what is most certainly clear is that this is, for all accounts and purposes, a mess: not only are there two sides to the story, but the same people are involved in two different lawsuits in two different states. It could not be clearer that, even in the rare cases where a celebrity has taken the time to plan their estate, unexpected situations can still come up. Of course, looking at Jimmy Buffett’s estate still reveals a few different lessons we can take home regarding estate planning:

1. Be Picky: It is extremely important that you pick the right person as trustee for your estate. If you don’t pick someone you trust to manage it well, you may put yourself at risk of asset mismanagement by someone who breaches their legal duty to act in your best interest.

2. Be Perceptive: That have been placed in the trust, as well as any income those assets generate) and a trustee (who manages the distribution of the trust’s assets). It is vital to ensure that these two people (if different) not only get along, but are capable of making proper decisions about your assets on your behalf. If you have two co-trustees, like Mr. Buffett did, it is also important to make sure they work well together: otherwise they may have contentious battles in court, wasting both money and time.

3. Be Prepared: Finally, you need to be prepared for life to take unexpected turns! Whether it is through the inclusion of specific language in your trust, a continuous updating of your existing trust documents for when changes in the law occur, or simply getting started with a trust in the first place, putting a plan in place is the best way to ensure that your assets are going to be handled in the way you wish them to.

At Trust Counsel, We Help You Avoid Unnecessary Drama

The truth is, estate planning is tough work, and you shouldn’t do it alone. Here at Trust Counsel, we’re committed to ensuring that you can be adequately prepared for the future, that your assets are protected, and that your loved ones are cared for according to your desires, and are here to help guide you through every step of your estate planning process. Whether you need to create a will, set up a trust, or review and update your existing estate plan, we’re here for you. Contact us today to craft an effective estate plan tailored to your needs.