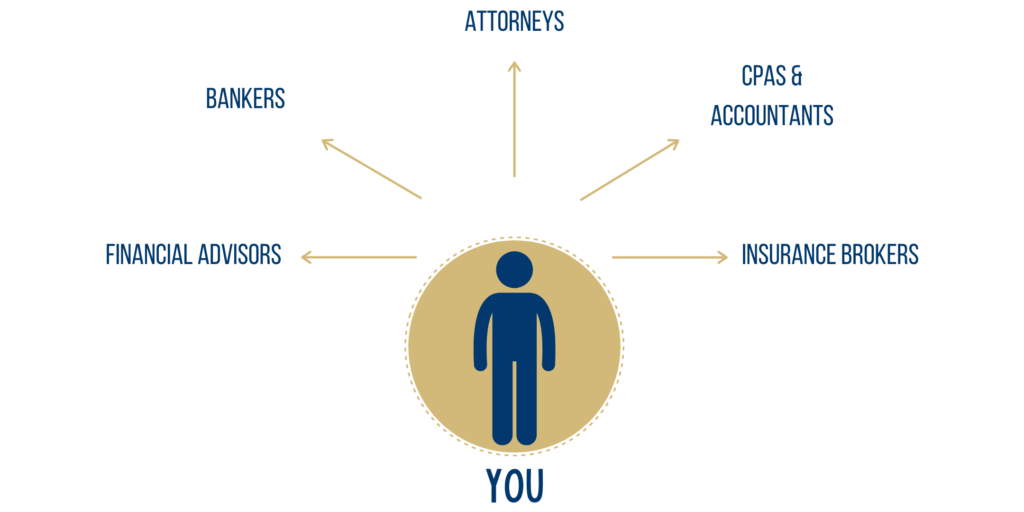

I am always preaching that there are 5 people you want on your side when building your family’s trusted advisory team: 1) Attorney, 2) Accountant, 3) Insurance Advisor, 4) Financial Advisor, and 5) Banker. Your personal financial dream team will help you navigate the harsh waters of this thing we call LIFE, where what you don’t know about what you don’t know about each of those areas can end up costing you a lot of money in the long run.

The financial advisor is a critically important advisor for a family but just how does one go about finding a great one when (just like looking for a lawyer to best advise your family) it can be an intimidating process. It’s not just a numbers game of finding who is best at beating the market. It’s a personal relationship, and a search for someone who will listen to you and work with your family to achieve your overall goals.

A common misconception I hear is that only those with large chunks of money to invest need a financial planner… Not true! Everyone needs a planner, in the same way that everyone needs a personal family lawyer or a general family doctor. Everyone needs to be educated about cash flow, debt, savings, goal setting, planning for goals and retirement, asset protection, titling assets, insurance and tax planning.

More and more I get asked what I think about “robo-advisors”. What in the world is that, you may ask? Well, they are sophisticated computer softwares that choose your investments and automatically “rebalance” them. Do a Google search and you will find lots of them. They offer automated investing advice, and come at a lower cost, but it’s not personalized. My opinion is that there are really only two types of people who should use that service: someone who is very investment savvy and has time to do a lot of research, and someone who has a small amount of money and just wants to get started.

For everyone else, a real human financial planner can do a comprehensive financial plan, guide you in money matters like taxes or insurance, or manage your investments for you. Even if you are a do-it-yourselfer, a planner can review your investments to make sure you’re on track.

So how do you go about finding a great advisor for you and your family?

As your Attorney: I really do recommend you start by asking your estate planning attorney for a referral. We work with so many advisors throughout the years and we get to know them, their strengths, and their main focus. We also get to know you and your family’s wealth and unique dynamics. This puts us in a unique situation of being able to assess who would generally be a good fit for you – saving you lots of time!

Do your research: Look at a planner’s website for his or her specialization, such as college or retirement planning, and read the bio. While you shouldn’t believe everything you read on the internet, there are tons of reputable sources for financial information online, including government resources like Investor.gov and the Financial Industry Regulatory Authority. Check the CFP Board website or Finra.org, for any disciplinary history for unethical or unlawful acts.

Look for professional designations: Anyone can call themselves a financial planner. You can find them at banks, brokerage houses, insurance agencies and independent firms. The gold standard is a certified financial planner (CFP) or a chartered financial consultant (ChFC), who has taken extensive classes on several aspects of financial planning. Another designation to look for is someone who has pledged to work at a “fiduciary standard,” which means they have promised to put their clients’ best interest above their own, and recommend products that are best for the client, even if that means fewer dollars in their own pocket.

Look at how they charge: Some planners are fee-only and do not make money on the investments they sell. Some charge an hourly rate for advice or a flat rate per project. Others charge an annual percentage of your assets, typically 0.5 to 2 percent, to manage them. Some earn commissions based on what you buy. Fees should be based on the scope of a client’s needs, if they are looking for asset allocation, that will be easier than if and advisor needs to do a comprehensive financial plan. I have seen that some planners offer a second opinion for do-it-yourself investors who have their money with low-cost brokerage houses like Vanguard, Fidelity or T. Rowe Price, or who have most of their funds tucked in a 401(k). Since in those situations clients don’t have a chunk of money that needs to be actively managed, an option could be that those people would pay a flat fee for a year of planning and guidance.

Actively participate in the initial meeting: To start, make appointments for an initial consultation. Be prepared to do some of the talking in the interview. Prepare to ask many questions. Remember, it’s a personal relationship you are looking for – you have to feel comfortable, and you have to be able to trust the person that’s going to work with you. Just like when you go to the doctor, bring a list of questions. Look for someone who listens. You want to make sure you find someone you’re comfortable with and who is comfortable answering your questions. Here are a few questions for the prospective financial advisor to get you started:

- Tell me about your experience in this field. How long have you been in it?

- What are your qualifications and education?

- What professional organizations do you belong to?

- What services do you offer?

- What is your investment philosophy — conservative or aggressive?

- What types of clients do you typically work with?

- Who will handle my account?

- How are you paid?

- What are your typical fees?

- Are there any conflicts of interest in the products you sell?

- Ask about access. How often can you meet or have phone consultations?

- Ask about the team. If you’re going to be assigned to a member of the planner’s team, you should interview that person as well.

A good financial advisor will understand your family and help you reach your financial goals. Picking the right financial advisor for your situation is key — doing so means you won’t end up paying for services you don’t need or working with an advisor who isn’t a good fit for your family or the nature of your assets at this time. I hope this helps you on your search for one of the most important people on the financial/Advisory team for your family. As always, reach out to me if you have any questions.