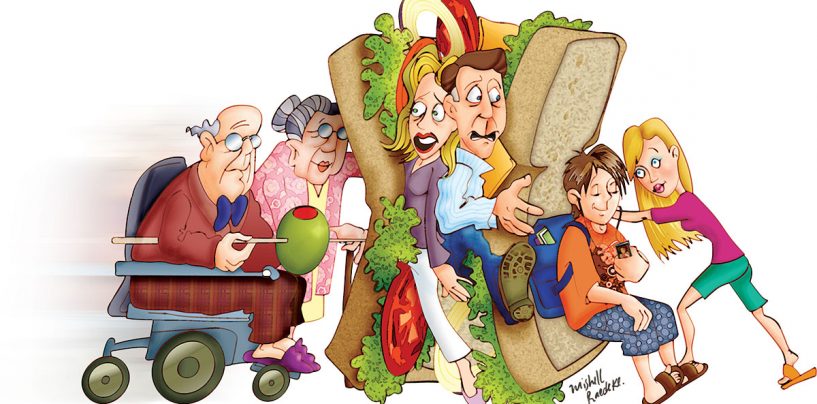

The average age of parents raising children in the US continues to rise, leaving many middle-aged Americans in a category commonly referred to as the the “sandwich” generation.

This growing population of professionals are often still raising kids at home when they become responsible for the care of their own aging parents. The stress and financial strain of managing the affairs of both children and parents can become overwhelming. The following tips can help make this challenging life stage manageable and more enjoyable.

Assess the Financial Situation

Taking time to thoroughly understand the financial picture for your own household is imperative as you step into a role of responsibility for your aging parent. Prepare for the inevitable and avoid surprises by working with a professional to consider how your role in the care of your parent will affect the plans you are making for your family’s financial future. Take advantage of our Family Wealth Planning Session process, a comprehensive planning process that ensures your legal, financial and insurance needs are covered appropriately.

Plan Ahead

Benjamin Franklin is quoted as saying that, “Failing to plan is planning to fail.” Planning for your family’s future means preparing for the worst and hoping for the best. As you move through helping your aging parent with important Estate Planning decisions, take time to be sure your own wishes are legally binding as well.

Be sure to include:

- Medical power of attorney – appoints a person to make medical decisions if you are unable to do so

- Durable power of attorney – designates a person to make financial decisions if you are unable to do so

- Living will – expresses your wishes for end of life decisions

- Will – carries out your wishes in the event of your death

- Kids Protection Plan – designates a legal guardian for your minor children in the event of your incapacitation or death

Pay Attention to Red Flags

Even if your aging parent is still quite capable, work together to assess their financial situation carefully and be on the lookout for signs that anything is falling through the cracks. Common red flags are:

- Frequent calls from creditors

- Forgetfulness when it comes to bills and deadlines

- Unopened mail

Utilize professional legal and financial support when necessary and communicate clearly so everyone knows who is responsible for what.

Practice Good Self Care

Stress is one of the most common consequences of caring for two generations at once. Balancing the responsibilities of raising children and caring for aging parents with relaxation and play is vital over the long-haul. Remember that adequate rest and good nutrition will provide you with the extra energy you’ll need when times get tough. Most importantly, remember that you don’t have to do it alone! As your Estate Planning Lawyer, we are ready to assist you when duty calls.

Now is the perfect time to schedule a Family Wealth Planning Session, where we’ll review your current financial situation in light of your future responsibilities. With our assistance, you’ll gain the confidence of knowing you’re making the most empowered, informed and educated legal and financial decisions for yourself and the ones you love.