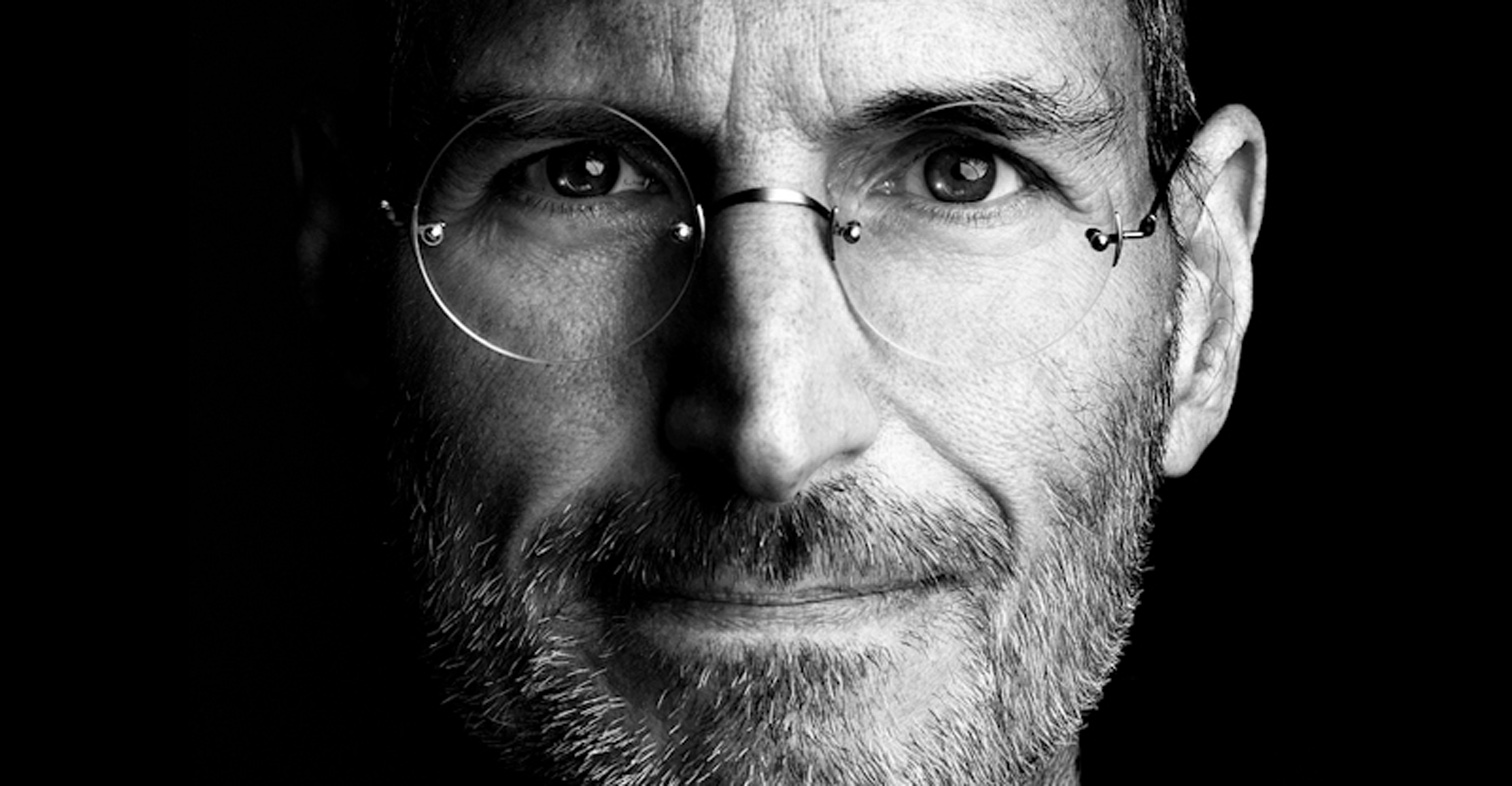

After the death of Steve Jobs the rumors started circulating that he was so smart that he even knew how to avoid paying estate taxes better than anyone else. Jobs was smart and he seems to have had an attorney do a great job with his estate planning, but he certainly did not transfer billions of dollars in wealth to his family tax free.

After the death of Steve Jobs the rumors started circulating that he was so smart that he even knew how to avoid paying estate taxes better than anyone else. Jobs was smart and he seems to have had an attorney do a great job with his estate planning, but he certainly did not transfer billions of dollars in wealth to his family tax free.

With his wealth at an estimated $7 billion and his health in decline, Jobs was a smart man who wanted to keep his affairs private. Along these lines, it is believed that Jobs used living trusts to protect his estate and keep his assets within the family. In March 2009, two months after Jobs stepped away from Apple (for a second time), Jobs and his wife transferred three pieces of real estate in California into two separate trusts. Trusts prevent disclosure of the assets upon death and reduce estate taxes – which back in 2011 was as high as 35% (remember the Estate Tax is now 40%**).

Though it is impossible for this to be confirmed – unless someone files his Will in probate – legal experts agree that this move by Jobs is an indication he used living trusts. By funding his trusts with those pieces of real estate, Steve Jobs properly planned his estate.

Now, Jobs might have left all of his assets to his wife, in which case no taxes are due until his wife dies. But it does not take a genius to do that. Leaving everything to the spouse is the most common estate plan there is, and it merely defers the tax bill until his wife passes away.

Jobs also might have given a portion of his estate to charity, which would reduce his tax bill, but also reduces the amount his family inherits.

The most important point here is that we don’t know what he did, and we are likely not to find out what he did, because he set up trusts and transferred assets to those trusts while he was still living. That keeps his finances private, which is something many other celebrities have been unable to do.

Jobs probably did not invent some new way to avoid estate tax, but he got the important things right.

**On January 1, 2013, the American Taxpayer Relief Act of 2012 was passed which “permanently” establishes an exemption of $5 million, as 2011 basis with inflation adjustment, per person for U.S. citizens and residents, with a maximum tax rate of 40% for the year 2013 and beyond.