Farewell to Galactic Icons

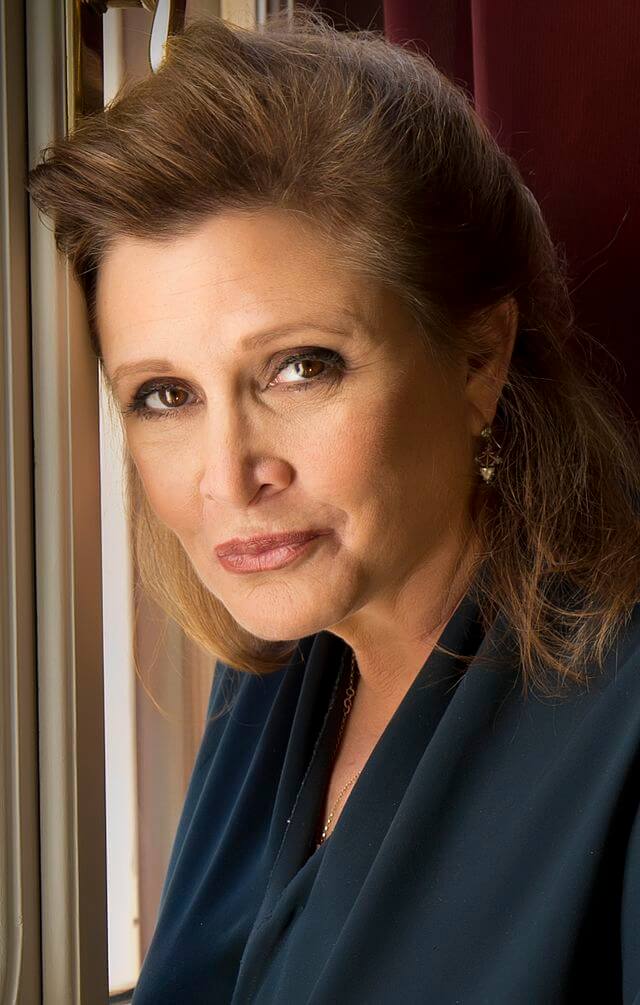

In a galaxy not so far away, the world said goodbye to two remarkable individuals in late 2016. Carrie Fisher, who played the role of the both beloved and iconic Princess Leia for the Star Wars Franchise, as well as her mother, Debbie Reynolds. As news broke of their unfortunate deaths fans of the Cosmic franchise were left mourning the loss of their galaxies star. The legacy of princess Leia, portrayed with resilience and grace by Carrie fisher had captured the hearts of many, while Debbie’s outstandingly diverse career as a singer actress and businesswomen had earned her a place in the public eye. With their death however came the cosmic pondering of their substantial estates. With Carrie’s net worth estimated at around 25 million USD and Debbie’s fortune reaching a staggering 85 million USD, it was clear that the future of their legacies would be a topic of great interest.

Curiosity Surrounding their Estates

The suddenness of these tragic events only intensified the curiosity surrounding their estates. Uncertainty loomed as it was unsure whether or not Debbie Reynolds had left behind a will or any estate planning documents, leaving questions about how her wealth would be distributed. Given her close relationship with her sister and mother, it was widely speculated that Todd Fisher, Carrie’s brother, would inherit a significant portion of his mother’s estate. Additionally, there was Carrie’s daughter, Billie Lourd, whose position as an heir was not guaranteed. To unveil the truth and fulfill the last wishes of the deceased, the intricate process of probate had to commence, involving meticulous file examinations and estate plan reviews.

Unveiling the Comprehensive Estate Plans

Later it was fortunately revealed that both Carrie Fisher and Debbie Reynolds had created comprehensive estate plans. Debbie’s will and trust given approximately half of her assets to her daughter Carrie, who had chosen her daughter Billie Lourd as the sole beneficiary of her estate. Although Carrie passed away before her mother, her share was intended to pass to Billie as stipulated in her will.

Billie Lourd Inherits the Cosmic Fortune

At the young age of 24, Billie Lourd found herself becoming the rightful owner of her mother’s possessions as well as her share of Debbie Reynolds’ estate. This included film rights, copyrights of Carrie’s books and works, personal belongings, vehicles, jewelry, and even the luxurious Beverly Hills Estate. However, it was later decided to put the real estate up for sale, with the proceeds going to Billie.

But was this estate plan foolproof, considering the circumstances and complexities involved?

Lessons from Fisher and Reynolds’ Estate Planning

Let’s extract some valuable lessons from the case of Fisher and Reynolds:

1.Survivorship: Carrie’s untimely demise before her mother raises an important consideration in estate planning. If you leave assets to a beneficiary who, unfortunately, passes away before you, it’s crucial to determine whether your will still stands. To address this, you can include a clause stating that your assets will be bequeathed to the beneficiary only if they survive you for a specified duration, typically a month.

2.Primary and Secondary Beneficiaries: When crafting your last will, it is wise to name both primary and secondary beneficiaries. In the event that your primary beneficiary predeceases you, the secondary beneficiary will assume their position. This approach mirrors the situation with Debbie Reynolds. Additionally, it may be prudent to designate a final beneficiary in case both primary and secondary beneficiaries pass away simultaneously. You can also specify a point at which your estate should pass to charity or another organization, such as when no surviving direct family members can be found, thus avoiding the unintentional bequeathment to distant relatives.

3.Age Matters: Trusts can be instrumental in managing the distribution of funds to beneficiaries, particularly when they reach a specific age. Considering the potential risks of entrusting a considerable sum to a young person, it is advisable to consult a Wills and Trust lawyer when establishing a trust. They can guide you on the best methods to protect the wealth of minors and young adults.