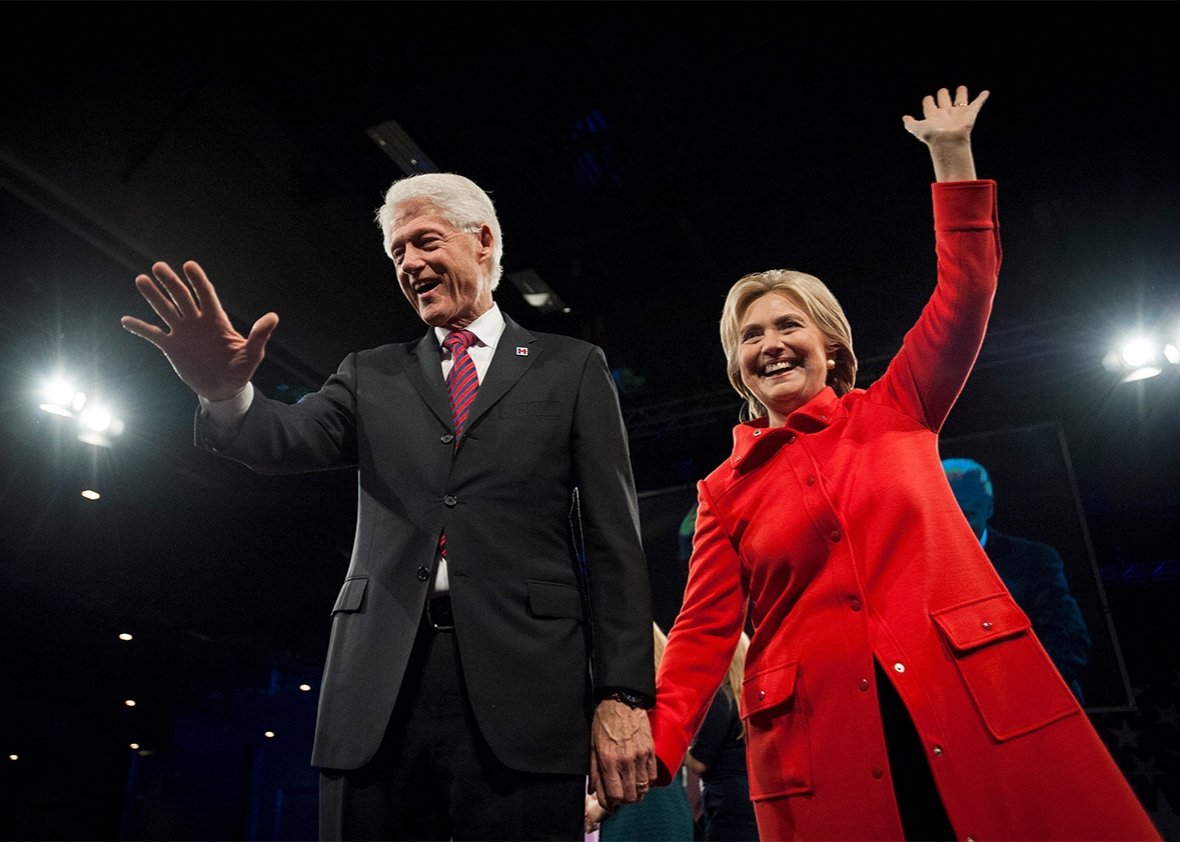

In anticipation of the election and in response to public demand, Hillary and Bill Clinton have released their 2015 federal tax return. Tax returns have been a hot topic this year, as candidate Donald Trump continues to refuse to release his tax returns.

What can you learn from reviewing the Clinton’s tax returns about how to save money on your own taxes?

First and foremost, plan ahead and plan well, and this is the time of year to do it, especially if you are self-employed.

Much of the focus on the Clintons’ latest federal return has been on issues relating to self-employment. For example, the Clintons claimed over $10 million in self-employment income from activities such as speaking engagements, consulting, and book royalties, and yet they paid far more on their taxes than they would have, with better planning.

A few of the things they overlooked (or chose not to utilize due to potential public scrutiny or political backlash), that you can benefit from:

- Incorporate your business and have it taxed as an S-corporation, then pay yourself a small, but reasonable salary and take the rest of your income via profit distributions, saving big on self employment taxes. Most self-employed business owners are missing this major tax saving opportunity, including the Clintons (which cost them over $348,000).

- Maximize your retirement plan contributions each year, either to an IRA or self-employed 401k. Not using a plan like this, likely cost the Clinton’s more than $40,000. But, it’s not too late for you to set up a retirement plan that will allow you to defer taxes on income you are saving for retirement, if you begin planning now. Once the end of the year has come and passed, it will be too late for this year.

- Consider changing your state of residence.

If you are self-employed or retired, you may have flexibility about where you establish yourself as a resident.

It appears the Clintons could have benefited substantially by planning their state of residence, which is currently listed as NY, with a nearly 9% state income tax rate.

State tax rates vary considerably, from 0% in some states, such as Florida and Texas, to 13.3% in California. It is important for high net worth taxpayers to actively plan their state of residency. Perhaps after the Clinton’s are done with politics, they’ll consider spending more than half their time in one of those states, which could save them more than $1,000,000 per year. This is not the first time the Clintons have been criticized for paying more tax than was due and having it cost the charities they support, as a result.

In 1998, the New York Times ran an article that showed how the Clintons could have structured book royalties from “It Takes a Village” slightly differently (sending the royalties directly to charity, rather than to Hillary Clinton first, limiting the total deduction to just half her income, would have netted the charities an additional $32,000 that went to the government instead). Don’t make the same mistakes as the Clintons and let your tax bill get the better of you. This is the time of year to be considering how best to save on the taxes you’ll pay next April.

Call today for a Family Wealth Planning Session and as part of it we can spot opportunities you may want to consider, and take advantage of to keep more of your hard-earned money in your pocket.

As an Estate Planning Lawyer, we take the time to get to know you and the things that are most important to you. Through this ongoing relationship, we are able to help advise you about the best ways to preserve and protect your assets for life.