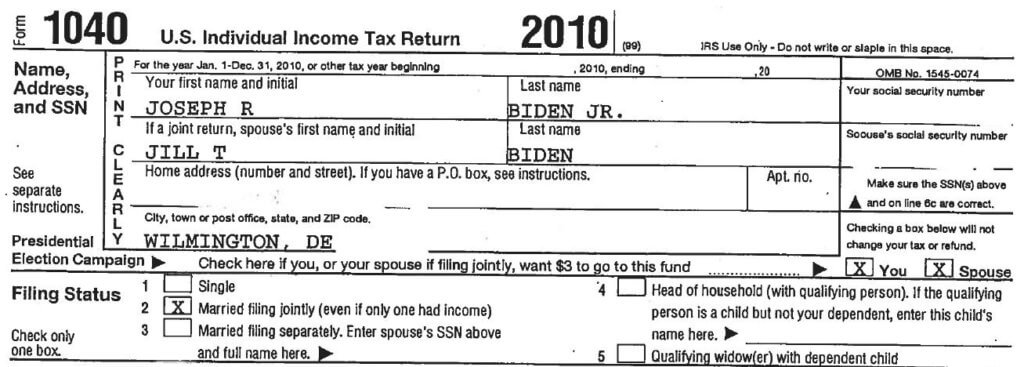

There is nothing like a presidential candidate’s personal income tax return to get people talking. And, while the battle over the federal tax returns of President Donald Trump continues to leave many people wondering what his tax returns may reveal, we no longer need to wonder about presidential candidate Joe Biden’s returns. So, 2020 democratic presidential candidate, Joe Biden, released three years of his income tax returns a few weeks ago. And what we learned by looking at Joe Biden’s tax returns is that tax planning is the key to both paying your fair share and keeping your taxes as low as legally possible.

So, what well-known tax planning strategy did former vice president Joe Biden use to help him pay less taxes? Biden’s income tax returns show that he used S Corporations. An S-corporation allows self-employed individuals to avoid excess taxation by running profits through a legal business entity. Generally, business owners are subject to a self-employment tax of 12.4% for Social Security, 2.9% for Medicare, and 15.3% combined Social Security and Medicare tax. But when business owners use S-corporations, the S-corporation pays its employee/shareholders in two ways: wages and distributions, where the distribution portion is not subject to Social Security and Medicare taxes. This is precisely the result that vice-president Joe Biden achieved by using S corporations.

In 2017 and 2018, Biden and his wife reported a joint adjusted gross income of almost $16 million, most of it from two S-corporations – CelticCapri Corp. and Giacoppa Corp. – both which handle their book deals and speaking engagements. But because the couple took a salary of only $800,000 over those two years, $13 million of those profits were not subject to self-employment tax, significantly reducing the amount of income taxes paid for that period. In fact, had they been taxed on the full amount of their reported income, the Biden’s would likely end up paying another $500,000 or more in additional taxes.

In 2017 and 2018, Biden and his wife reported a joint adjusted gross income of almost $16 million, most of it from two S-corporations – CelticCapri Corp. and Giacoppa Corp. – both which handle their book deals and speaking engagements. But because the couple took a salary of only $800,000 over those two years, $13 million of those profits were not subject to self-employment tax, significantly reducing the amount of income taxes paid for that period. In fact, had they been taxed on the full amount of their reported income, the Biden’s would likely end up paying another $500,000 or more in additional taxes.

Clearly, vice president Joe Biden has been carefully tax planning to reduce his taxes. But tax planning isn’t just for politicians making millions of dollars each year. Even small business owners can greatly benefit from establishing the right legal business entity for tax purposes. In addition to reducing the amount of taxes paid, filing as an S-corporation can sometimes offer added protection to small- to mid-size companies. This added protection comes in the form of the business loss deduction which, if needed, allows small business owners to offset losses with a smaller chance of getting flagged for auditing by the IRS.

So, there is nothing sinister about the strategy vice president Joe Biden used. Arranging one’s affairs to keep taxes low is standard practice from the largest corporations down to the first-time filer. Therefore, there is no question that creating an S-corporation solely to reduce taxes is a legitimate and widely used business practice. Keep in mind however, that none of these benefits can be accessed without setting up an S-corporation correctly in the first place. In addition, business owners that have S-corporations should remember that the Internal Revenue Service requires that S-corporations owners pay reasonable compensation to employee shareholders for services performed before making non-wage distributions to them. This is where quality tax planning becomes an essential part of any business venture.

Recent Comments